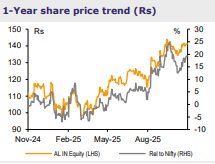

Buy Ashok Leyland Ltd for the Target Rs.160 By Emkay Global Financial Services Ltd

Sustained margin performance; growth outlook improving

AL logged a strong Q2, with revenue up ~9% YoY (on 6/3% YoY volume/ASP growth) and EBITDA up 14% YoY; EBITDAM rose by 100bps QoQ, driven by cost-rationalization-led operational improvement. The management remains optimistic about faring better in H2 vs H1 on GST-cut-led improvement in demand trends in both, LCVs and MHCVs (industry’s 2-4trn LCV/MHCV volumes up 15/7% YoY in Oct-25). AL’s exports are seeing strong momentum (up 35% in FY26YTD) and it targets 18k/25kpa units in FY26/next 2-3Y, led by strong traction across key export geographies. The mgmt highlighted: i) leaner balance sheet with profitable growth, ii) premiumization (new launches at higher pricepoints for better realization), iii) strong FCF (to sustain investments), as three key focus areas. Multiple product launches in H2 (to drive volume, market-share gains) and rising share of higher margin non-truck revenue (~50% share) would drive sustained margin improvement. We hoist FY26E/27E/28E EPS by 3/6/10% to factor in improving demand outlook for CVs and robust margins. We retain BUY and raise TP to Rs160 (by ~7%) at 12x Sep-27E EV/EBITDA.

Healthy top-line growth with sustained margin performance

Revenue was up 9% YoY to Rs95.9bn, led by 6%/3% growth in volume/ASPs to 48.3k units/Rs2mn. EBITDA was up 14% YoY at Rs11.6bn with EBITDAM expanding by 100bps QoQ to 12.1% driven by 30bps/130bps lower QoQ staff costs/other expenses and partially offset by 50bps QoQ gross margin contraction. Overall, adjusted profit stood at Rs8.1bn; the PAT beat was driven by EBITDA beat + higher than expected other income.

Earnings call KTAs

1) The management remains optimistic about the growth prospects in H2 (expected to be better than H1); owing to the GST-cut-led demand boost, LCV sales already picking up, MHCVs to be buoyant in H2 (industry’s MHCVs/2-4trn LCV volumes are up 7/15% YoY in Oct-25), led by broad-based consumption improvement and rising infrastructure spends. 2) With new differentiated products (multiple launches planned over Q3/Q4), AL aims to i) drive volume growth, ii) gain market share, and iii) improve margins in H2. 3) The mgmt highlighted some key focus areas: i) sustaining a lean balance sheet and profitable growth, ii) premiumization via higher-value products to command better ASPs, iii) strong cash flows to sustain investments. 4) MHCVs transitioning to the AC cabin norms; AL has passed-on cost to clients (hence, gross margin largely upheld in Q2). 5) Exports are up 35% YoY in FY26YTD and AL targets achieving 18kpa/25kpa units by FY26/next 2-3Y (20% CAGR) on strong demand in key export markets (SAARC, GCC, Africa, ASEAN). 6) Higher margin non-truck revenue is 50% of AL’s revenue (FY22: 40%) with strong traction in engines, power solutions, defense, spare parts, etc. 7) Ongoing capacity expansion to raise AL’s bus body building capacity from 12kpa units to 20kpa units. 8) LCV capacity to be raised to 120kpa units (80kpa units now) without any major capex, led by process/efficiency changes. 9) Switch mobility has turned EBITDA/PATpositive in H1FY26 and AL targets an FCF-positive stance by FY27. 10) FY26 capex guidance: Rs10bn; investment in subsidiaries to not exceed Rs5bn.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354