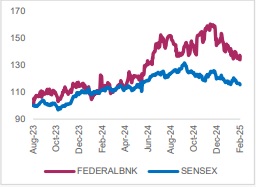

Buy Federal Bank Ltd For Target Rs. 225 By Axis Securities

.jpg)

Building on Momentum; Execution Remains Key!

We attended the Analyst Meet hosted by Federal Bank to chalk out the strategy and growth roadmap for the bank under the new management, spearheaded by Mr KVS Manian, along with insights from other senior management team members of the bank. The bank has outlined a 12-theme ‘Project Breakthrough’ identifying growth levers for the bank to ensure strong and sustainable growth, as it intends to be placed amongst the Top-5 private sector banks over the next 3-5 years. Of these 12 themes, FB’s priority remains on (1) CASA Deposits mobilisation, (2) Strengthening Fee income profile and (3) NIM improvement

Key Takeaways

• Building a Granular Deposit Franchise with Increased Focus on CASA: The reorientation of branch strategy towards CASA Deposits, particularly CA deposits, remains a key focus area for the bank. Over the medium term, the bank expects to improve the share of CASA Deposits from 30% in FY25 to 36% in FY28, with a significant improvement in CA deposits from 6% of Total deposits in FY25 to 10% of total deposits by FY28, despite higher competitive intensity. The bank has taken several measures to improve the CA portfolio through product innovation and has seen strong traction in the past 3 months. FB’s management believes that the strength of the CA franchise in the core state of Kerala remains largely untapped and offers the potential to grow. Similarly, the bank will look to improve the CA efficiency metrics at the branch and employee levels. Additionally, improving the segmental proposition to strengthen its customer engagement by becoming the customer’s primary banker through customised product offerings would also help CASA accretion (by 2-3x times). Moreover, the bank will look to enhance its engagement with capital markets (high transacting ecosystem), which tend to support CASA deposits. Apart from this, the bank will further diversify its base by tapping high CASA-potential markets beyond the GCC and Kerala corridor. Thus, FB’s strategy revolves around building a granular – CASA and Retail TD deposit franchise to ensure stability and LCR efficiency and maintain the cost of funds. We expect FB to deliver a healthy 16% CAGR deposit growth over FY25-27E while maintaining a steady LDR (84-85%)

• Navigating Near-Term Challenges with Focus on Mid-Yielding Segment; Accelerating Growth as Clarity Emerges: Amidst macro uncertainties and asset quality challenges in the unsecured segments, FB has managed to drive healthy credit growth, better vs systemic growth. In Q3FY25, FB’s credit growth slowed down to 15%/flat YoY/QoQ (vs average growth rate of ~19-20% over last nine qtrs). The higher-yielding portfolio contributes to ~25.8% of the total portfolio vs 24.6/24.9% YoY/QoQ. Hereon, the bank will adopt a calibrated approach to reshaping its advances mix, with the near-term focus on mid-yielding secured retail assets to help improve NIMs, especially with uncertainties persisting. However, as better clarity on growth trends emerges (likely from FY26E) and the private capex cycle picks up, FB will look to accelerate growth by expanding unsecured, high-yield credit to optimise portfolio returns. Apart from its existing product portfolio, FB will also look at a foray into (i) scaling up used vehicle finance book (used cars, CV/CE), (ii) Tractor Finance, (iii) Affordable Housing Loans, (iv) Sustainable Finance, (v) Micro-LAP Offerings, (vi) EMI-Based Unsecured Biz Loans, (vii) Real Estate Finance, (viii) Correspondent Banking amongst others. The management has indicated that the bank will eye growth at 1.5x Nominal GDP growth. FB will not shy away from exploring inorganic growth opportunities. We expect FB to deliver a strong 17% CAGR credit growth over FY25-27E.

NIM Improvement Remains Priority: The bank’s re-aligned strategy on CASA deposits, particularly CA deposits, to optimise CoF and gradual improvement in yields with accelerating growth in the higher yielding segments should help FB gradually improve its NIMs. Near-term challenges on margins would be visible with the EBLR-linked loans repricing given the rate cut, while the downward repricing of CoF would be with a lag, especially with intense competition on deposit mobilisation and tighter liquidity conditions. Management has indicated that the NIM improvement over the medium term would be largely driven by a sharper improvement in the CoF rather than yield enhancement

Outlook and Valuation

With the new management at the helm, the bank’s strategy re-orientation revolves around ensuring sustainable, profitable growth while maintaining strong asset quality metrics. While growth is likely to face headwinds in FY25 owing to unfavourable macros, we expect growth momentum to resume from FY26E onwards. Additionally, a clear focus on improving profitability with better NIMs and strengthening the fee profile should enable FB to deliver RoA/RoE of 1.2- 1.3%/13-15% over the medium term. While we remain certain of the management’s ability to deliver its strategy, we would remain watchful of the execution process and the potential nearterm challenges owing to the execution. We retain our estimates for FY25-27E. We maintain our BUY recommendation on the stock, with an unchanged target price of Rs 225/share, implying an upside of 25% from the CMP. We value FB at 1.4x Sep’26E vs its current valuations of 1.2x Sep’26E ABV while assigning a value of Rs 10 to its subsidiary.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633