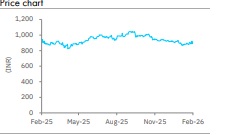

Buy Zydus Lifescience Ltd for Target Rs 1,311 by Elara Capitals

Mirabegron concern resolved; visibility up to FY28

Zydus Lifescience (ZYDUSLIF IN) has entered into a settlement of intellectual property (IP) dispute with Astellas Pharma over the Mirabegron product, branded as Myrbetriq. The product is currently contributing upwards of USD 300mn in annual revenue for ZYDUSLIF, as per our estimates. As per the terms of the Agreement, ZYDUSLIF will pay Astellas a USD 120mn fixed payment plus an undisclosed per-unit license fee for each unit of product sold from the date of settlement to September 2027. This eliminates IP risks associated with the product and improves the visibility of the product up to mid-FY28, although it reduces the profitability to the extent of the license fees. We raise our FY27E & FY28E core EPS estimates by ~17%. We reiterate Buy with a TP of INR 1,311.

Following the Lupin precedent: Lupin (LPC IN, Accumulate, CMP: INR 2,209, TP: INR 2,239) had entered into a similar settlement couple of days ago under which it agreed to: USD 90mn fixed amount, and an undisclosed per-unit license fee for each unit of LPC Product sold from the date of settlement to September 2027. The product currently contributing upwards of USD 100mn annually to LPC’s US revenue, as per our estimates. We expect LPC and ZYDUSLIF to gain exclusive generic sales rights until September 2027, after which we expect other generic players to enter the market.

Better US revenue outlook: With this development, we expect ZYDUSLIF’s US revenue to grow in low single digits in FY27, vs earlier expectations of ~10% decline in USD terms. FY28 will likely see stronger growth at 20%+ despite gMyrbetriq coming off mid-way, owing to the large gIbrance product that enjoys first-to-file (FTF) exclusivity. FY29 visibility remains limited, but several pipeline products could emerge as growth drivers.

Robust growth from other businesses: ZYDUSLIF’s India business and RoW businesses continue to grow in low- and high- double digits, respectively while med-tech has emerged as a new growth engine with execution focused. Acquisition of Comfort-Click in the UK bolsters consumer sales growth.

Other medium-term growth drivers exist: ZYDUSLIF’s vaccine business also continues to pick up with some large tender wins from global procurement agencies. Contributions from smaller M&A, such as Sterling Bio facility and Agenus Bio facility in California, will also bloster 2-3 year growth trajectory.

Reiterate Buy with a TP of INR 1,311: We raise our FY27E & FY28E core EPS estimates by ~17% during FY27-28, as we build in higher gMyrbetriq revenue. ZYDUSLIF trades at 21.6x FY27E core P/E. We reiterate Buy with a TP of INR 1,311 on 24.2x FY28E core earnings (lower multiple due to the higher contribution from one-off product) plus cash per share. Unexpected competition or regulatory setbacks in key products and setbacks in IP-related litigations in the US are downside risks.

Please refer disclaimer at Report

SEBI Registration number is INH000000933.