Buy PI Industries Ltd For the Target Rs. 4,265 by the Axis Securites

Recommendation Rationale

Headwinds in CSM Business to continue in Near-Term: PI’s CSM business showed a modest 2% YoY growth, with volumes increasing by 5% YoY and new products growing by 40% YoY in Q3. However, due to declining demand, the management anticipates a recovery in H2CY25, expecting high inventories in certain products to decrease by that time. Accordingly, the management has revised its revenue growth forecast for FY25, lowering it from high single-digit to low single-digit growth.

Biologicals gaining momentum: PI’s domestic segment saw a 5% YoY growth in the quarter, reaching Rs 280 Cr. This growth was primarily fueled by a 7% YoY increase in volume, a 20% YoY rise in revenue from biological products, and favourable agronomic conditions. The company launched six new brands in the domestic market and plans to introduce more products while expanding its biologicals business, accounting for approximately 15% of total revenue.

CRDMO and new products to drive growth: The Pharma segment saw a significant 55% YoY growth, contributing around 4% to total export revenue. PI is focusing on transitioning to the new CRDMO business model and is restructuring its product mix. The company plans to introduce new products and customers as it develops its new technology platform. Management expects a revenue growth of 20-25% once the new business model stabilises. PI has identified three new projects to drive long-term revenue growth and has secured a key CDMO order for a new program.

Sector Outlook: Cautiously Optimistic

Company Outlook: The management anticipates muted demand in the near term and has revised its revenue growth guidance from high single-digit to low single-digit, as the global industry landscape continues to be challenging. However, the management remains hopeful of a recovery in the second half of CY25. PI also has a robust pipeline of over 20 products at different stages of development and registration, which are expected to be key drivers of growth in the medium term. The company plans to spend Rs 800-1000 Cr on Capex for FY25.

Current Valuation: 28x FY27E (Earlier: 28x FY27E)

Current TP: Rs 4,265/share (Earlier TP: Rs 4,850/share)

Recommendation: We maintain our BUY rating on the stock

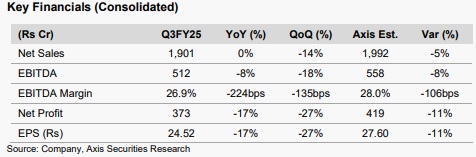

Financial Performance: The company’s consolidated revenues stood at Rs 1,901 Cr, up 0.2% YoY and down 14% QoQ, missing our estimate of Rs 1,992 Cr. Gross margins declined to 52.7%, down from 53.9% in Q3FY24. The company reported an EBITDA of Rs 512 Cr, down 8% YoY and 18% QoQ, and missing estimates by 8%. EBITDA margin came in at 26.9%, compared to 29.2% in Q3FY24 and 28.3% in Q2FY25. PAT stood at Rs 373 Cr, down 17% YoY and 27% QoQ, missing the estimate of Rs 508 Cr

Valuation & Recommendation: We believe PI’s strong financial position and focus on exploring growth opportunities while improving profitability through a better product mix position it well for long-term growth. However, given the near-term industry headwinds and high inventory levels with innovators, we expect revenue growth to decelerate. Consequently, we have trimmed our estimates and continue to value the stock at 28x FY27E. We maintain a BUY rating on the stock with a revised target price of Rs 4,265/share, implying an upside of 21% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633