Neutral M&M Financial Services Ltd For Target Rs. 280 By Yes Securities Ltd

Awaiting a consistent performance

Higher NPL addition continues; PAT beat on ECL model revision

MMFS’s PPOP was in line with our estimate, but the PAT stood much higher at Rs9bn owing to the annual revision of ECL model that lowered LGD from 59.5% to 50.1%. This reduction of LGD caused significant provision release of Rs4.34bn (Rs3bn/Rs1bn on Stage-3/Stage-2 assets) in the quarter, underpinning negligible credit cost despite higher write-offs (Rs4.44bn v/s Rs2.96bn in Q2 FY25). Actually, the net NPL addition (adj. for write-offs) remained elevated at ~Rs6.6bn (~Rs8.2bn/~Rs6.2bn in Q2/Q1 FY25). While slippages in Tractors were sequentially lower, it remained significant in LCV financing. Owing to the revision of LGD, the ECL coverage on Stage-2 assets declined to 9.1% from 10.6% in Q2 FY25.

Overall disbursements grew 25% qoq/7% yoy aided by improved traction in PV (up 33% qoq/8% yoy), CV/CE (up 27% qoq) and Tractors (up 59% qoq/24% yoy). Business Assets grew by 2.4% qoq and 18% yoy with the sequential growth impacted by repayment of trade advances from dealers. Disbursement growth in a key segment of Used Vehicle financing was weak (lower 1% qoq/3% yoy) for the third consecutive quarter. Some improvement in Portfolio Yield and fee income drove 10 bps qoq expansion in NIM (from 6.5% to 6.6%), even as funding cost increased marginally.

Management continues to aspire for 15-20% growth, 2% RoA for coming years

MMFS continues to harbor expectations of delivering higher teens AUM growth aided by 1) targeting of better location/dealer coverage and prime customers in PV financing, 2) improved growth execution in Used Vehicle financing, 3) sustaining traction in Tractor loans and 4) further scaling-up of SME book. NIM is expected to be in corridor of 6.5-6.7% in the near term with peaking of funding cost and some improvement in yield on the back of product mix shift and remaining benefits from the rate actions taken. With further benefit from ECL coverage reduction unlikely, the credit cost would be driven by the trends in net NPL addition and write-offs. Management commented that PDs are likely to rise in the current environment, quantum of write-offs would moderate, and disposal losses would be controlled. Opex/Avg. Assets is aspired to be maintained in the narrow band of 2.5-2.7%.

Improved disbursement and asset quality performance remains key

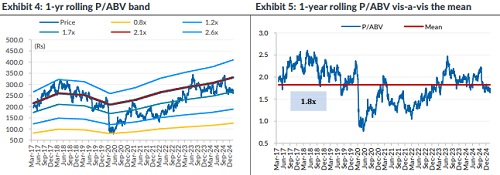

MMFS trades at 10x P/E and 1.5x P/BV on our FY27 estimates. Valuation re-rating would be a function of better control over asset quality, meaningful visibility of midteen growth and turning of the rate cycle. Hence, the key triggers for stock price rally would be improvement in collection efficiency, NPL resolutions and disbursement growth rate. Maintain Neutral rating on MMFS till then.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632