Reduce Kotak Mahindra Bank Ltd For Target Rs. 1,950 By Emkay Global Financial Services Ltd

Leadership reset done; awaits higher growth, RoE reset

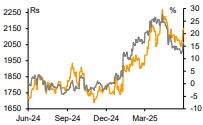

We met Kotak Mahindra Bank (KMB)’s management, to understand the impact of the recent monetary policy and the company’s long-term growth plan. The bank believes that recent policy overtures could accelerate systemic credit growth, more so from 2HFY26, with meaningful pick-up likely in FY27 even as the demand scenario improves. The bank retains its broader credit growth guidance range of 1.5-2x of nominal GDP growth, while its near-term focus will be on limiting margin contraction in view of the sharp rate cuts. The bank has seen a complete change of guard in the past 18M, while strategically buying small retail asset portfolios. However, we believe that it needs to shed its traditional stutter-step growth pattern (seen again in 2HFY25) and reset its growth stance, if it aspires to emerge as the third-largest private bank by core profitability/RoE on consolidated basis (FY25 @13% ex-KGI divestment vs large peers’ at ≥15%), as guided by the new MD and CEO. We retain REDUCE on KMB and TP of Rs1,950 (valuing the SA bank at 1.9x FY27E ABV and subs at Rs625/sh), given rich valuations for sub-optimal return ratios (RoEs) vs peers.

Near-term focus will be on margin management, though it needs to reset longterm growth stance

KMB’s credit growth slipped to 13.5% YoY/3% QoQ from 17.6% in FY24, mainly due to its traditional conservative growth approach (given surfacing of some asset quality risk), which we believe it needs to refine (albeit without compromising on quality), in order to consume its ultra-high capital and thus meet its aspiration of emerging as the 3rd largest private bank in terms of profitability/consolidated RoE. KMB recently launched ‘Solitaire Credit Card’ to boost its card portfolio, though we believe that it will take some time to get its mojo back and regain the lost market share. The bank is likely to remain cautious on the MFI front in the near term, as asset quality stress persists; it would instead focus on the secured segments for driving growth which could exert more pressure on margin. KMB is largely done with SA rate cuts, akin to peers, and may thus resort to sharp cuts in the TD rate to reduce its CoF and protect the margin. However, given KMB’s higher share of the repo linked book (60%), we believe it could still be exposed to higher margin risk in 1HFY26 and possibly see some relief in 2H, as benefit of CRR cut + deposit rate catches up.

Card, PL stress has largely eased; specific PCR shored up, though lacks contingent provision buffer

KMB believes that stress in unsecured loans (including Cards and PL) has eased, though MFI stress persists and it would hence remain vigilant. Also, KMB had earlier pointed to rising dislocation in VF (including in the CV segment) which was reflected in the increase in NNPA for subsidiary Kotak Prime in 4Q. The bank has shored-up specific PCR to 78%, though it does not carry contingent provision buffer similar to peers.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354