Reduce Vardhman Textiles Ltd For Target Rs. 458 By Elara Capital

Textile segment buoys Q4

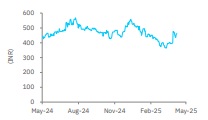

Vardhman Textiles’ (VTEX IN) Q4 revenue was largely in-line, while EBITDA missed our estimates by 15.3%, due to higher-than-expected other expenses. PAT came in 6.1% higher than our estimates due to higher other income and lower interest cost and tax rate. Indian cotton continues to remain expensive than international cotton, impacting the profitability of spinners such as VTEX. Its synthetic fabric and existing products fabric plant is expected to be complete by Q2FY26, which should drive growth in FY27. We pare our FY26E earnings estimates by 7.8% (given near-term pressure on margin) and FY27E estimates by 5.0%. We also introduce FY28E earnings. Accordingly, we lower our TP to INR 458 (from INR 482), valuing the stock at 7.5x FY27E EV/EBITDA (7.8x earlier). We maintain Reduce rating.

Revenue flat; bottomline up 18.3% YoY: Revenue grew 2.0% YoY to INR 25,086mn, led by a 1.9% YoY growth in textiles and 5.5% YoY growth in Acrylic Fiber. Yarn volume grew 0.9% YoY. VTEX is operating at full utilization, at 94.5% for yarn and 93.4% for processed fabric segment. Gross margin increased by 115bps YoY to reach 44.3% on account of increase in spread led by raw material procurement at lower prices. EBITDA decreased by 6.9% YoY due to increase in other expenses by 11.5%. We expect margins to reach 16.0% by FY28E, on the back of improvement in product mix and likely reversion of spreads, led by improvement in demand.

Textile – Traction in margin: Textile reported a revenue of INR 24.6bn, up 1.9% YoY, whereas the Acrylic segment grew 5.5% YoY to INR 721mn in Q4. The Textile segment reported an EBIT margin of 12.5%, up 164bps YoY. EBIT rose by 17.3% YoY to INR 3.1bn. The Acrylic segment delivered an EBIT loss margin of 1.3%, down 680bps YoY.

Capex on schedule: VTEX is likely to complete its yarn modernisation and fabric capacity expansion by Q2FY26. It has paused expansion in yarn capacity due to uncertainty on improvement in demand and pending government approvals. The company incurred a capex of ~INR 10bn in FY25 and we expect a capex of INR 13.2bn in FY26. This capex is likely to improve profitability through mix improvement and cost efficiencies.

Maintain Reduce; TP pared to INR 458: We expect an earnings CAGR of 6.9% through FY25- 28E led by improvement in margin given the operationalization of new plants. However, the current environment presents an opportunity for the company to grow its market share, as the US plans to impose higher tariffs on multiple trading partners.

VTEX’s foray into synthetic fabric products appears at an opportune time, which we view as positive. But given the uncertainty in demand environment and continued pressure on margins, we pare our earnings estimates by 7.8% for FY26E and 5% for FY27E. We introduce FY28E. We maintain Reduce rating with a lower TP of INR 458 from INR 482, based on 7.5x (from 7.8x) FY27E EV/EBITDA. Key triggers are improvement in demand, favorable cotton price scenario and better cotton yarn spreads.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)