Buy Persistent Systems Ltd for the Target Rs. 6,160 by Axis Securities Ltd

Mix-bag Performance; Superior Execution

Est. Vs. Actual for Q2FY26: Revenue – INLINE; EBIT Margin – BEAT; PAT – INLINE

Change in Estimates YoY post Q2FY26:

FY26E/FY27E: Revenue: 2%/4%; EBIT: 2%/10%, PAT: 4%/14%

Recommendation Rationale

* Growth Outlook: The broader economic environment continues to remain challenging, with clients keeping tight control over discretionary budgets. The management remains optimistic about the continuation of the company's growth momentum and niche business verticals.

* Deal Wins/Pipeline: The Total Contract Value (TCV) stood at $609 Mn and $448 Mn in Annual Contract Value (ACV) as of Sep’25. The company is confident in its pipeline of larger deals with a healthy executable order book.

* AI Strategy: Persistent Systems has restructured its AI strategy around four key pillars, i.e AI for Technology, AI for business and Enterprise Data Readiness for AI.

Sector Outlook: Cautiously optimistic

Company Outlook & Guidance: The management remains confident in achieving its $2 Bn revenue target by FY27, supported by a combination of organic growth, core operational efficiencies, and an active acquisition strategy. For its longer-term aspiration of reaching $5 Bn revenue by FY31, the company plans to strategically expand into the manufacturing and retail verticals, thereby diversifying its growth engines and broadening its addressable market. Furthermore, the management is focusing on new areas within Healthcare services and BFSI, with an aim to deepen its presence across multiple sub-segments within these verticals.

Current Valuation: 44x FY27E P/E (Earlier Valuation: 51x FY27E P/E)

Current TP: Rs 6,160/share (Earlier TP: Rs 6,240/share)

Recommendation: We maintain our BUY rating on the stock.

Financial Performance

In Q2FY26, Persistent Systems reported revenue of Rs 3,581 Cr vs Rs 3,334 Cr in Q2FY25, registering a growth of 23.6% YoY and 7.4% QoQ. In CC terms, revenue grew by 4.4% QoQ to $406 Mn. EBIT stood at Rs 583 Cr vs Rs 406 Cr in Q2FY25, up 43.5% YoY and 12.6% QoQ, driven by strong topline growth. Net income came in at Rs 471 Cr vs Rs 325 Cr in Q2FY25, reflecting a growth of 45.1% YoY and 11% QoQ. However, attrition rose by 180 bps YoY to 13.8% from 12.0% in Q2FY25. The company reported a Total Contract Value (TCV) of $609 Mn, with $448 Mn in Annual Contract Value (ACV) as of Sep’25.

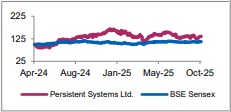

Relative Performance

Outlook

From a long-term perspective, we believe Persistent is well-placed for encouraging growth, given its multiple long-term contracts with the world’s leading brands. Its improved revenue visibility gives us confidence in its business growth moving forward.

Valuation & Recommendation

From FY22–25, the company’s Revenue/EBIT/PAT grew at a CAGR of 28%/30%/27%, respectively. The distinctive value proposition and ability to conclude important strategic deals amid an uncertain environment provide confidence in its execution capabilities. Therefore, we maintain a BUY rating on the stock and assign a 44x P/E multiple to its FY27E earnings to arrive at a TP of Rs 6,160/share, implying an upside of 15% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Ltd ( 1 ).jpg)