Buy Persistent Systems Ltd For Target Rs. 6,140 By JM Financial Services

A near-perfect quarter

PSYS’ 2Q performance addressed most of investor concerns, in our view. Revenues grew 4.4% cc QoQ, exceeding expectations (JMFe: 3.4%). Rebound in Healthcare & Lifesciences (+3.8% QoQ) and top-5 clients (7.8%) indicate PSYS is offsetting planned offshoring in its top account and navigating regulatory challenges in this vertical well, allaying concerns. Sharp pick-up in ACV (+28% YoY), which was tracking below revenue growth, should build-back confidence in growth sustaining into FY27. Only soft spot was 10% decline in net new TCV even as overall TCV grew 15%. That could be attributable to quarterly fluctuations, in our view. License revenue share, another investors’ worry, fell 120bps, implying an even stronger 5.6% QoQ services growth. That (+80bps), along with offshoring and FX benefit aided margin beat. EBIT margins expanded 80bps (JMFe: 50bps), positioning PSYS comfortably to achieve its 100bps margin expansion in FY26, despite wage hike ahead. PSYS’ consistent strong performance, despite unchanged macro, underlines its head-start in AI-offerings, relentless execution and an eye on client diversification. This is a strong blue-print for predictable growth. We therefore raise our FY26-28E cc growth 150-220bps, though keep margin estimates largely unchanged, driving 1.5- 4.5% EPS increase. Such consistency merits premium valuation. BUY.

* 2QFY26 – strong performance: PSYS reported 4.4% cc QoQ growth, a beat on JMFe: 3.4%. BFSI (+7% QoQ; USD terms) and Hi-tech (+2.2%) demonstrated growth and Healthcare & Life Sciences (+3.8%) also picked up. Interestingly, while growth was led by top 10 accounts with top 5/6-10 cohorts growing 7.8%/5.3% QoQ in USD terms, top 11-20 cohort saw a 1.1% decline. EBIT margin increased 80bps to 16.3%, a beat on JMFe: 16.0%. Software-license cost reduction (+80bps), FX movement (+60bps), planned offshore transition (+30bps) aided margins, while higher doubtful debt provisions (-50bps), lower utilization (-20bps), and higher depreciation and amortization costs (-20bps) were headwinds. PAT came in at INR 4,715mn (+10.9% QoQ), a beat on expectations (JMFe: INR 4,552mn).

* Deal wins and outlook: TCV/ACV for the quarter grew by 15.2%/28.6% YoY. Book-to-bill increased to 1.5x after 1.34x in Q1, which was an eight quarter low. ACV/TCV ratio increased to 74% (+770bps YoY). Management highlighted that while the macro environment has not changed, customers are increasingly adapting to and operating within the current environment. While BFSI continues to anchor growth, Hi-tech and software vertical expected to remain stable, and Healthcare expected to recover. Client discussions remain active across platform-led and modernization programs, with SASVA and GenAI gaining traction. For now, the company reiterated 200-300bps margin expansion target by FY27 end (+100bps in FY26, and +100bps in FY27), to be supported by margin levers and platform productivity. Wage hikes are now effective Oct 1, 2025 onwards. Management expects ~180bps impact of the wage hike in Q3, to be partially offset (~80-100bps) by margin levers including offshoring, utilization, subcontractor rationalization, SG&A optimization and ESOP cost reduction.

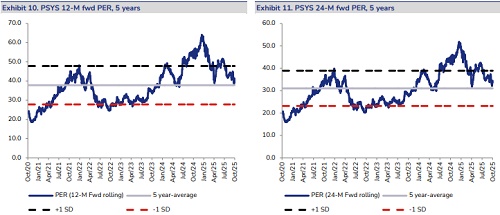

* Increase EPS by 1.5-4.5%; Maintain BUY: We have raised FY26-27E cc revenue growth by 150-220bps, on the back of pick up in ACV (+28% YoY). Largely unchanged margin assumptions however drive 1.5-4.5% EPS change. We continue to value the stock at 40x, justified in our view. Maintain BUY.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361