Accumulate JSW Infrastructure Ltd For Target Rs. 338 By Prabhudas Lilladher Capital Ltd

Strong NSR offsets weak volume impact

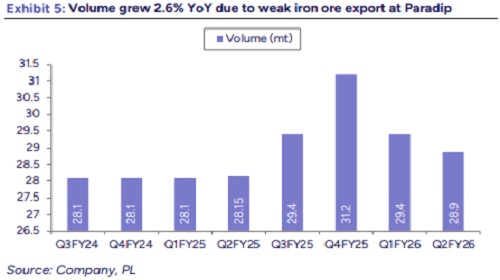

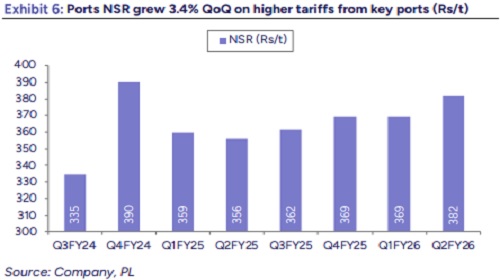

JSW Infra reported decent Q2FY26 operating performance, with robust ports NSR and a growing contribution from the logistics business offsetting tepid volume growth. Cargo volumes were impacted by weak iron ore exports at Paradip Iron Ore Terminal (down 2.1mt YoY), though strong throughput at Jaigarh, Dharamtar, and SWPL partially mitigated the volume loss. Port operations NSR grew 3.4% QoQ to Rs382, driven by higher volumes at better priced Jaigarh and Dharamtar ports, along with rate increases at SWPL and Ennore coal terminals. Volume growth is likely to be supported by the strong steel demand in H2 and the commissioning of the LPG terminal at JNPT.

The upcoming Kolkata Container Terminal is expected to contribute incremental volumes from FY27, while ongoing brownfield expansions at Jaigarh and Dharamtar position JSW Infra to benefit from rising demand driven by the Dolvi steel capacity ramp-up in FY28E. Over the longer term, the company’s ambitious port capacity roadmap to 400mt by FY30 along with greenfield projects at Jatadhar, Keni, Murbe and active participation in major port privatization bids, are expected to support strong third-party cargo volume growth. Navkar’s turnaround and the Kudathini acquisition aim to create a pan-India multi-modal network expanding its logistics business. We expect JSWINFRA to deliver revenue/EBITDA/PAT CAGR of 23%/24%/19% over FY25–28E. The stock is trading at EV of 22.1x/17x FY27E/FY28E EBITDA. Maintain ‘Accumulate’ with TP of Rs338 valuing at 21x EV of Sep’27E EBITDA.

* Revenue aided by higher Ports’ NSR:

Consolidated revenue grew 26% YoY to Rs12.65bn (3% QoQ; PLe of Rs12.27bn) aided by recently acquired logistics business and better Ports NSR. Port ops revenue grew 10% YoY to Rs11bn (1.6% QoQ; Ple of Rs10.6bn) while cargo volumes grew 2.6% YoY to 28.87mt (-2% QoQ; Ple of 28.5mt). Third party cargo share declined to 46% in Q2 due to iron ore export volume loss at Paradip terminal (-69% YoY to 0.96mt). Ports ops revenue per ton improved 3.4% QoQ to Rs382 (7.4% YoY; Ple of Rs373/t). Ports ops EBIT/t improved 14.5% YoY to Rs171 on higher volumes from Jaigarh & Dharamtar ports and rate hikes at SWPL & Ennore coal terminals.

* Navkar Corporation leads logistics business:

Navkar delivered strong 19% YoY revenue jump to Rs1.62bn (aided by strong domestic volumes) with an EBIT of Rs104mn (on track to deliver Rs1bn EBITDA for FY26E). ICD and CFS’s volumes increased by 21% and 20% YoY to 20k TEUs and 59k TEUs respectively, whereas total domestic cargo volumes was up 46% to 394,000t, which led to logistics revenue growing by 17% QoQ.

* EBITDA aided by increase in NSR:

EBITDA increased 17% YoY to Rs6.1bn (5% QoQ; Ple of Rs5.92bn) on higher volumes from Jaigarh (5% YoY to 5.46mt) & Dharamtar (4.2% YoY to 6.15mt) volumes having better NSR. SWPL volumes grew 70% YoY to 2.22mt on weak base while Ennore coal volumes declined 6% YoY to 2.43mt. Cons PAT declined 3% YoY to Rs3.6 (-6% QoQ; lower than PLe of Rs3.9bn) due to forex losses led by sharp currency depreciation on FC loans (USD120m in FY25).

Q2FY26 Conference Call Highlights:

Operational Highlights:

* The mgmt. reduced the full year volume guidance to 8–10% for FY26.

* Overall growth was impacted by subdued volumes at Paradip Iron Ore Terminal (down 2.1mt) due to weak global macro conditions affecting iron ore exports. Otherwise, growth could have been 10%. H2 is expected to perform better than H1, supported by firming iron ore prices in October.

* Third-party volumes declined marginally by 1% YoY, mainly due to weak cargo at Paradip Iron Ore Terminal.

* Not expecting much impact on volumes from shutdowns at Vijaynagar Steel Plant.

* Volume increased by 3% YoY, driven by strong performance at South West Port, Jaigarh Port, Dharamtar Port, and interim operations at Tuticorin and JNPA Liquid Terminal.

* Realisation was up 7% YoY, driven by additional cargo-related services at Jaigarh, Dharamtar, and South West ports.

* Share of group volume increased to 54% from 52% last year.

* Capacity utilization improved due to strong performance at South West Port, Dharamtar Port, Paradip Coal, and Ennore Coal.

* Recognized unrealized FX loss of Rs50mn due to USD/INR fluctuations and changes in the yield curve.

* Capex of Rs33bn has been committed, with Rs9.02bn spent in H1FY26. Capex of Rs40bn for Ports and Rs15bn for Logistics, totaling Rs55bn for FY26.

* Net debt stands at Rs18.10bn, with net debt to EBITDA of 0.75x.

* Effective tax rate was 20% versus 33% previously, due to ESOP tax credit and adoption of tonnage tax for four MDCs at Jatadhar Port starting FY26.

Logistics:

* Acquired an 86-acre brownfield rail siding in Kudathini, Ballari (Karnataka), being transformed into an MMLP. Operations expected to start in 2–3 months. Total investment Rs3.8bn (including Rs570mn for the acquisition).

* EBITDA guidance of Rs1bn for FY26 is maintained.

* To achieve Rs80bn revenue by 2030-31: JSW’s plan includes 284 rail routes (107 specialized, 177 container), setting up 30 terminals, and purchasing containers along with container trains. Revenue split expected to be 60% domestic and 40% EXIM; group customers to contribute 35-40%.

* Capacity increase at Navkar: 60 acres at Panvel and 40 acres at Murbhe. At Panvel, 10-12 acres will be used immediately; the rest will be utilised later based on opportunities. Current utilisation is 60–65% at Mumbai and 55–60% at Murbhe.

* Started transporting tiles from Murbhe to Kolkata and returning with cargo to Mumbai and Murbhe. Three services have been completed so far.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271