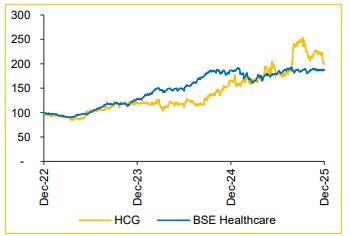

Add Healthcare Global Enterprises Ltd for Target Rs. 800 by Choice Institutional Equities

Streamlined portfolio to enhance growth and profitability trajectory

HCG is undertaking a strategic portfolio realignment so as to sharpen its focus on specialised oncology care, systematically exiting non-core multispecialty operations. This repositioning is expected to strengthen its differentiated offering for international patients while reinforcing leadership in key domestic markets.

The planned divestment of the fertility business will streamline the organisational structure and enable redeployment of capital towards higher-margin, bettergrowth oncology verticals. With this focussed approach, the company is targeting 15–20% revenue growth and an EBITDA margin of ~20% by FY28.

We forecast revenue/EBITDA/PAT to expand at a CAGR of 16%/20.5%/82.2% over FY25–FY28E. Supported by superior clinical outcomes, increasing case complexity, favourable mix shift and asset-light expansion, we raise our EV/EBITDA multiple to 20x (from 17x) on average of FY27–28E and revise our TP to INR 800 (vs INR 700), while retaining our ADD rating.

Solid QoQ recovery with higher occupancy and margin gains

* Revenue came in at INR 6.5 Bn (in-line with CIE est.), up 16.9% YoY and 5.5% QoQ

* ARPOB stood at INR 44,355, down 1.8% YoY and 0.9% QoQ, while occupancy improved to 70.3% vs. 67.2% in Q2FY25

* EBITDA came in at INR 1.2 Bn (in-line with CIE est.), up 20.6% YoY and 14.4% QoQ. EBITDA margin came at 19.1% (vs. CIE est. of 18%), expanded by 59 bps YoY and 148 bps QoQ

* PAT came in at INR 0.16 Bn (vs. CIE est. of INR 0.14 Bn), down 9.1% YoY and up 244.4% QoQ.

Capacity expansion to propel multi-year growth

HCG is positioned for a powerful growth cycle driven by disciplined expansion and substantial latent capacity. The existing network operates at only 50–60% of its revenue potential, providing a long runway for scale-up at minimal incremental Capex. The plan is to expand capacity through brownfield additions in Ahmedabad, Cuttack, Baroda and Vizag, and greenfield expansion in 2–3 new cities over the next 2–3 years. Cumulatively, HCG expects to add ~1,000 beds, taking the total capacity to ~3,500 beds and 10 new LINACs, funded by INR 600– 700Cr capex over 2–3 years, of which INR 300Cr is maintenance Capex.

Metro cluster ARPP strength propels superior profitability

HCG’s key metro clusters remain important profitability drivers, given their strong operating metrics and improving realisation levels. Across regions, the company has demonstrated consistent ARPP momentum: the West cluster has delivered a 6% ARPP CAGR, the East cluster 9% and the South cluster 2%, supported by a robust volume growth and a shift towards more complex treatment. As HCG continues to deepen its mix in advanced therapies, such as transplants, robotics, precision radiation and immunotherapy, we expect steady ARPP improvement, going forward. This case-mix enrichment, combined with ongoing scientific pricing reviews and continued reduction in institutional payer exposure, positions the company for sustained revenue optimisation and margin expansion across its metro platforms despite broader sector pricing constraint.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)