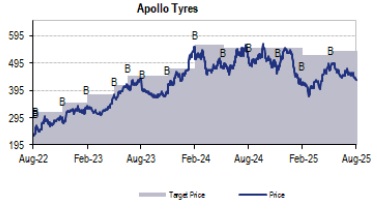

Buy Apollo Tyres Ltd for the Target Rs. 500 by JM Financial Services Ltd

Apollo Tyres (APTY) reported a consolidated EBITDA margin of 13.2% in 1QFY26 (-110bps YoY, +20bps QoQ), in line with JMFe. The YoY EBITDA margin contraction was due to higher raw material and employee costs. In India, OE and replacement demand saw mid-single-digit growth, which was offset by a decline in exports, leading to flat YoY volume growth. Despite a decline in the European industry (due to seasonality and weak demand), APTY maintained its revenue on a YoY basis. The management expects domestic market demand to recover in 2HFY26, supported by continued momentum in replacement demand (high single-digit growth). In Europe, APTY expects operating performance to recover with improved demand in the latter half of FY26, supported by a focus on mix improvement and cost efficiency. On the margin front, a rich product mix, stable raw material costs, the closure of the Netherlands plant (benefit to accrue from FY27), and continued cost control initiatives are expected to support margins in the medium term. We have revised our EBITDA margin estimates downwards by 70bps/50bps for FY26E/FY27E versus previous estimates. Consequently, adj. EPS declined 9%/8% for FY26E/FY27E. Maintain BUY and ascribe 15x PE to arrive at Mar’27 TP of INR 500.

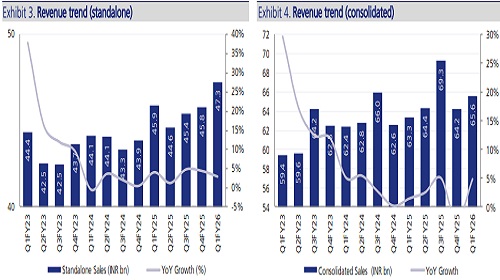

* 1QFY26 – Margin in-line with estimate: APTY reported standalone revenue of INR 47.2bn (+3% YoY, +3% QoQ). EBITDA for the quarter stood at INR 6.4bn (+2% YoY, +25% QoQ), with an EBITDA margin of 13.6% (-10bps YoY, +240bps QoQ). The sequential margin expansion was driven by easing raw material inflation. At the consolidated level, APTY reported revenue of INR 65.6bn (+3.6% YoY, +2% QoQ). Consolidated EBITDA margin stood at 13.2% (-110bps YoY, +20bps QoQ), in line with JMFe. The YoY EBITDA contraction was due to higher raw material and employee costs. Adjusted consolidated PAT stood at INR 3.8bn (+12% YoY, +26% QoQ), 17% above JMFe, driven by lower reported tax expense. However, reported PAT came in at ~INR 129mn (-95.7% YoY), impacted by restructuring costs at Apollo Netherlands (INR 3.7bn) and an employee restructuring exercise (INR 17mn).

* India business: For the India business, volumes remained flattish YoY during 1Q. Both replacement and OE segments posted mid-single-digit YoY growth, which was negated by a decline in exports. The OE segment saw improved performance in Q1 compared to the previous quarter, largely due to pre-buying on account of the mandatory AC cabin regulation in M&HCVs (PVs OE segment volume was slightly below). Within the replacement segment, TBR saw mid-single-digit growth (in line with the industry), while PCR saw low-single-digit growth (slightly below the industry). Further, APTY’s focus on premiumisation continues, and it registered its highest-ever Vredestein volumes in 1Q. Management highlighted that APTY lost market share in the PV OE segment in 1QFY26. In the replacement segment, while TBR held ground, the company lost market share in the PCR segment. Overall, the company expects recovery in 2HFY26, with the replacement segment maintaining its momentum (expects high single-digit growth in FY26). On the exports front, APTY aims to improve its market share.

* European business: Despite the decline in the European industry, APTY's EU operations reported revenue of EUR 146mn (flat YoY) in 1QFY26. In terms of volumes, the PCR segment was slightly higher, whereas special category tyre volumes declined 40%; agri and TBR remained weak. A rich mix supported the company’s revenue. Premiumisation efforts continued, with the share of UHP at 48% (vs. 48% QoQ). EBITDA margin declined 290bps YoY to 10.8%, due to negative operating leverage and inflation in raw material and other costs. Tariff exposure to the US remains minimal. Looking ahead, APTY expects demand recovery and improved operating performance in the latter half of the current fiscal, supported by capacity addition in Hungary (by end-CY25) and continued focus on cost control measures and sales mix.

* Margin outlook: Margins were impacted by negative leverage and higher cost inflation in EU operations. The RM basket cost is expected to be slightly lower in 2Q compared to 1Q. Further, the management expects the closure of the Netherlands plant and continued cost control measures to support margin performance.

* Capex/debt update: For FY26, the management maintained its capex guidance at INR 15bn (split between growth and maintenance capex). During 1QFY26, its consol. net debt declined to INR 21bn (vs. INR 25bn in 4QFY25), with Net Debt / EBITDA at 0.7x (vs. 0.8x in 4QFY25).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)