Company Update : Uniparts India Ltd by Nirmal Bang Ltd

* The Large Agri equipment is still seeing some weakness in next year but apart from this all other segment is seeing revival.

* Off-highway is a cyclical industry, and we have been seeing a down cycle in the US and European markets for the last 2 years. The cycle is generally 2–3 years down and 2–3 years up. We see the cycle is reviving, anyhow Unipart has outperformed the industry and gained market share. Uniparts will be able to benefit from the industry revival.

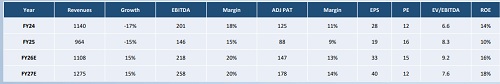

* The company is expected to deliver revenue and PAT CAGR of around 15% and 23% respectively over FY25–27, supported by demand recovery and margin expansion. At the current market price of Rs.496, the stock trades at 12.3x FY27E EPS, which appears attractive given its improving return ratios and debt-free balance sheet. We assign a ‘Buy’ rating with a target price of Rs.712, implying a potential upside of 43% from current levels.

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176