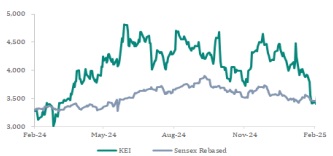

Buy KEI Industries Ltd For Target Rs. 4,103 By Geojit Financial Services Ltd

Capacity expansion to drive future growth

KEI Industries Ltd (KEI) is a leading manufacturer of cables and wires. It was established as a partnership firm in 1968 and incorporated as a public limited company in 1992

* Consolidated revenue from operations increased 19.8% YoY to Rs. 2,467cr, driven by strong demand in the Cables and Wires (C&W) segment, particularly for infrastructure and industrial projects.

* Revenue from the C&W segment grew 26.0% YoY to Rs. 2,352cr, boosted by a substantial increase in domestic institutional cable sales and a notable 31% YoY increase in export sales.

* Revenue from EPC projects plunged 79.9% YoY to Rs. 76cr, in line with the company’s strategic decision to scale back its focus on EPC projects and prioritise its C&W segment to capitalise on the robust demand.

* At the operating level, EBITDA was up 11.3% YoY to Rs. 254cr in Q3FY25 and the company targets to eventually reach 11-12.5% in 2-3 years.

* However, the EBITDA margin declined to 10.3% from 11.1% in the last year, primarily owing to fluctuations in raw material costs, thereby increasing the cost of sales.

* PAT was at Rs. 165cr in Q3FY25, up 9.4% YoY, driven by robust top-line growth.

Outlook & Valuation

KEI Industries logged substantial revenue growth during the quarter, driven by strong domestic demand and expanding global opportunities. The company expects sales growth of 19-20% in the upcoming year, driven by capacity expansions, rising domestic demand and strong growth prospects in the export markets. The company’s strategic focus on meeting this heightened demand is evident from its ongoing capacity expansion, which positions it to capitalise on future opportunities and improve operational efficiencies. Hence, we upgrade our rating on the stock to BUY based on 36x FY27E P/E with a rolled-forward target price of Rs. 4,103.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

.jpg)