Monthly Report December 2025 by Nirmal Bang Ltd

.jpg)

Market Outlook

* After a strong run up in Nifty in the month of October, as expected we saw consolidation in during the month of November which was also coincided with world market correction as well. But the real pain was visible in small and midcap stocks. The BSE small cap index underperformed not only in last one month but even for the whole year it is underperforming the NIFTY. This is getting reflected into the portfolio performance of most of the retail investor.

* The underperformance of small and midcap is mainly driven by earlier outperformance. BSE small cap is up by around 80% in last three year v/s Nifty around 42%. Apart from this, Domestic retail money which is flowing into the market through SIP or directly is been absorbed by primary issuance like IPO or QIP. These retail money was supporting Midcap and small cap stock earlier. The excess outperformance of Small and Midcap has taken the valuation of these stocks much higher and now seen consolidation or correction. We feel this trend will take some more time to normalize.

* September quarter result were more or less in line with estimates of analyst and expectation of batter performance in second half has build up. December quarter will be supported by strong festive demand GST reduction, lower interest rate and lower base of last year. Whereas March quarter will be driven by catch up of yearly targets, impact of good monsoon, continuation of benefit of GST reduction and lower interest rate and also lower base of last year. The much awaited deal with US on tariff can act as sentiment changer.

* Overall we expect December series will be positive and can see newer high on Nifty. The Nifty range expected for Dec series will be 25700-26700.

NIFTY TECHNICAL OUTLOOK

* The November month for Nifty was a good month as Nifty approached the 52- Week High level which also happens to be the 100% retracement level as per Retracement Theory (H-26,277.35, L21,743.65). Interesting observation that any retracement is observed Nifty has held consistently above the key 78.6% retracement zone near 25,279, signaling a strong bullish structure and healthy retracement behavior.

* For the short term, we may witness profit booking at higher levels as Nifty is strongly facing resistance at 52-week high levels. Immediate support lies at 25,870-25,840. If it breaks the support zone, we may witness profit booking which may take Nifty towards 25,470-25,240.

* The overall technical setup is positive as Nifty is trading in a formation of higher tops and higher bottoms, suggesting the uptrend is intact. Any dips towards 25,470-25,400 may be utilized to build up long positions in quality stocks, as 25,470 is strong support provided by the 50-DMA.

* A positive rally will be witnessed once Nifty manages to break out above the 26,280 mark. Above the 26,280 mark, we believe Nifty may continue its bull rally towards 26,400-26,600 in the near term.

* Bank Nifty witnessed positive momentum in continuation with its alltime high formation, with increasing RSI readings above 65. Bank Nifty gave a breakout of 59,500 mark we need to maintain a positive closing above 59,500. A consolidation above 59,500 will extend upward momentum towards the 60,500-61,400 levels. Support for Bank Nifty is placed at 58,000. A close below this level may lead to a sell-off towards the 57,200-56,200 zone

TECHNICAL STOCK PICK- GLENMARK

GLENMARK BUY– CMP Rs 1885

* Technically, Weekly chart indicates that Glenmark is consolidating after a strong impulsive rally, while respecting the rising trend line, thus suggesting underlying strength for a positive continuation.

* The interesting fact is to note that the stock formed a good base support near the 50% ratio of Fibonacci retracement from (H: 2284.8, L: 1336.3).

* Stock is witnessing the strong consolidation phase within the range of 1800-1900 zone since last one month. Looking towards the price momentum we believe stock may witness a breakout in near term and which will lead a rally towards 1970/2070

* The Relative Strength Index (RSI 14) is stabilizing after a corrective phase, hinting at potential momentum recovery if price sustains above immediate support.

* Buy Glenmark at 1885, ADD on dips at 1836 for a target of 2070 with a strict stop loss of 1790

TECHNICAL STOCK PICK-BAJAJ AUTO

BAJAJ-AUTO BUY– CMP Rs 9090

* Technically, weekly chart of BAJAJ-AUTO suggest that after sharp correction from almost 12,774 mark to 7200 level stock manages to show the reversal and trading in the forming of Higher tops and Higher Bottom pattern i.e. Upward rising channel indicating potential up move in near term

* Stock witnessed a breakout from its symmetrical pattern formation, thus confirming the positive trend.

* Interestingly the stock kept building base multiple times close to its 50% and 61.8% Golden ratio of Fibonacci Retracement from (H: 9490, L: 7858.5), thus indicating a positive demand.

* The long term setup is confirmed by the moving averages as the stock currently trades above all average i.e. 50,100,200 DMA.

* The momentum indicator RSI (14) is turning upward with positive crossover, thus reinforcing the strengthening momentum.

* Buy BAJAJ-AUTO at 9090, ADD on dips at 8870 for a target of 9750 with a strict stop loss of 8700

DERIVATIVES OUTLOOK

* The Nifty Nov rollover of 68.77% is lower than its Three months average of 80.31% and its six months average of 78.81%.

* The market wide rollover of 94.72% is at par than its three months average of 95.2% and its six months average of 94.09%.

* Nifty is opening the series with below average open interest indicating that the index can witness further buying in the series.

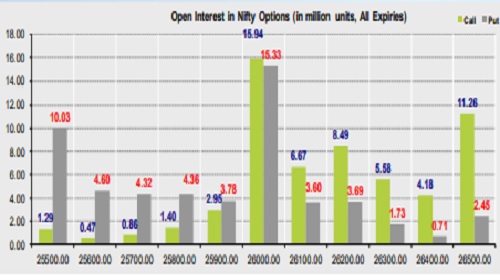

* The Index options OI for Dec series is indicating that index is likely to witness breakout and move higher.

* The PCR and VIX are both lower indicating positive bias for the Dec series.

* View: The index is likely to witness further buying In the November series and might see bouts of selling near resistances placed at 26500-27000 levels and supports placed at 25500-25000 levels

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176