Accumulate Dalmia Bharat Ltd For Target Rs.2,263 by Prabhudas Liladhar Capital Ltd

Waiting for price uptick across key regions

Quick Pointers:

* Demand showing signs of recovery in Dec’25 across regions; Near-term volumes to grow in high single digits YoY

* Long-term cost saving program (Rs150-200/t) on track; near-term cost curve flattish due to elevated marketing spends and few kiln shutdowns

We attended the analyst day of Dalmia Bharat (DALBHARA). The management highlighted demand weakness in key eastern states, while positive trends are seen across rest of the regions with a seasonally strong period rolling in. With demand in the South remaining stable and strong non-trade demand in the North-East, the management expects volumes to grow in line with the industry in H2FY26. Due to muted demand in the recent past amid GST rationalization, attempts to hike prices in the eastern region did not fructify in Dec’25. Further, going forward, pricing actions will solely depend on demand intensity. The management reiterated its confidence in the medium-term volume growth trajectory aided by ongoing capacity addition plans via the brownfield/ greenfield route and aims to reach its FY28E goal of ~70mtpa. The company maintained its cost reduction target of Rs150-200/t by FY28E, to be achieved via cost saving initiatives, fuel-mix optimization, and higher RE share. Prudent capital allocation remains its top priority post delays in the JPA deal.

We believe DALBHARA, in the near term, remains a price play on the eastern (having 60% of capacities, incl. North-East) and southern (34%) regions as intense competition from leaders continues to limit market share expansion. DALBHARA faces the risk of missing its medium-term capacity target due to issues in the JPA deal. However, we expect it to re-focus on organic expansion as it has enough capacity to cater to any surge in near-term demand. We cut our EBITDA estimates by 6%/5%/2% for FY26/27/28E and expect EBITDA CAGR of ~21% over FY25-28E. At CMP, the stock is trading at 10.6x/9.3x EV of FY27/FY28E EBITDA. Maintain ‘Accumulate’ with revised TP of Rs2,263 (earlier Rs2,372) valuing at 11x EV of Sep’27E EBITDA.

Demand recovery visible from Dec’25; East remains muted

The management highlighted that post-monsoon demand recovery was muted, impacted by festive disruptions and GST rationalization. However, demand has begun to improve from Dec’25 in the South. DALBHARA expects to grow in line with the industry in H2FY26, aiming at high single-digit YoY volume growth in the near term. Regionally, South India demand remains steady, while the East continues to be relatively muted, with Odisha, Bihar and West Bengal seeing slower project execution and muted trade demand. The North-East remains its strongest market, with significant capital inflows driving robust non-trade demand, while trade demand remains stable. Overall, the management highlighted that demand drivers are present across segments, but regional disturbances continue to drive near-term volatility.

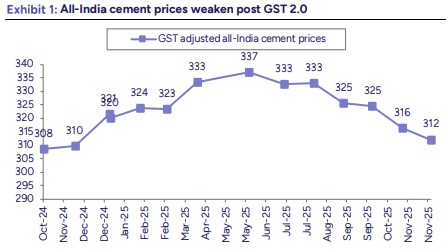

Price erosion due to muted demand post monsoon

Pricing pressure persisted during Q2FY26, with QoQ price erosion across most regions. The East/South witnessed ~4%/3% QoQ decline, mainly due to the nontrade segment. The North-East remained largely stable, resulting in a blended price decline of 3-4% QoQ. The management reiterated that GST rationalization has had no material impact on cement demand, as cement remains a largely price-inelastic product; however, premiumization has been observed in a few regions. The expected pent-up demand post Sep’25 also did not play out, leading to disappointment on near-term volumes and pricing traction.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271