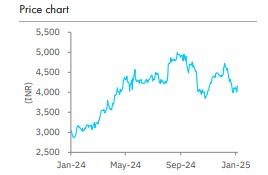

Buy InterGlobe Aviation Ltd For Target Rs. 5,309 By Elara Capital Ltd

Return of strong demand growth

We expect India’s aviation demand to strengthen (at 12% CAGR in FY25E-28E) from FY26 due to addition of new airports in Delhi and Mumbai by April ’25 (Source: Mint; The Times of India) and as InterGlobe Aviation’s (INDIGO IN) P&W aircraft return to operations along with terminal expansion in Bengaluru, Chennai, Ahmedabad and Kolkata by FY27-28. So, expect INDIGO to benefit from the above-mentioned tailwinds. The company’s plan to hedge 70% of its 12-month forward cash outflow in USD would significantly reduce earnings volatility emanating from currency fluctuation going forward. Reiterate BUY

Q3 reported PAT down 18% YoY but ex-forex adjusted PAT up 28% YoY:

INDIGO’s reported PAT was INR 24.5bn in Q3FY25 (Elara: PAT of INR 25.2bn, Consensus: PAT of INR 26.4bn). Adjusting for forex loss of INR 14.6bn, PAT was INR 39.1bn. Reported PAT was lower than expected on account of lower RASK (revenue per seat-km), while passenger growth and CASK (cost per seat-km) were in line with estimates

Operating data improves YoY;

passenger load factor (PLF) up: YoY PAT growth was led by growth in passenger volume and drop in fuel cost. CASK fell 3% to INR 3.8/seatkm (Elara: INR 3.8/seat-km), and RASK was flat YoY at INR 4.7/seat-km (Elara: INR 5.0/seat-km). PLF grew 121bps YoY to 87.0%. Notably, strong passenger growth at 13% YoY was witnessed after two quarters of weak growth (<10%) due to similar supply growth, which led to a slight correction in fares but mostly offset by strong demand growth

Aircraft grounding decelerating:

Currently, 60 aircraft are grounded (from high 60s in Q2FY25) due to P&W engine issues. Per management, aircraft on ground (AOG) would reduce to mid-40s by April-2025. Based on strong aircraft delivery rate from Airbus, INDIGO provided strong Q4 capacity growth guidance of 20% YoY. We expect that in the next 12 months, INDIGO’s non-fuel CASK would decline >5% due to return of grounded P&W engine fitted aircraft to operations

Set to capture most of the lucrative slots at upcoming airports near Delhi and Mumbai:

Given strong primary aircraft delivery rate by Airbus (seven per month in H2CY24) and return of grounded aircraft, there is high possibility of INDIGO receiving 50-60 new aircraft in H1CY25 (35-40 from Airbus; 15-20 grounded aircraft). The additional aircraft availability would give INDIGO an edge over competitors in acquiring lucrative time slots at upcoming airports near Delhi and Mumbai when these airports turn operational in Q2CY25

Reiterate Buy;

TP maintained at INR 5,309: We reiterate Buy given capacity expansion at major airports and the return of P&W fleet, even as competitors face constraint to aggressively add capacity. Our TP is based on FY27E EV/EBITDA, assuming one-year forward EV/EBITDA of 10.0x (unchanged). Key risks to our call are jump in crude oil prices to above USD90/bbl and delay in return to operations by AOG.

Please refer disclaimer at Report

SEBI Registration number is INH000000933