LPG Under-Recovery Narrows 35% QoQ for OMCs in Q1FY26 by CareEdge Ratings

Synopsis

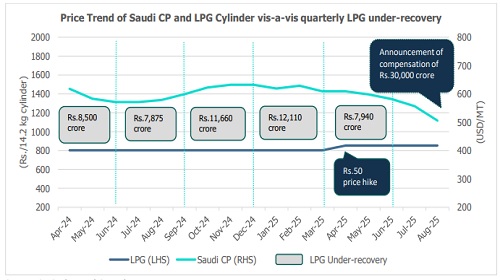

* In line with CareEdge Ratings’ detailed report on the LPG sector dated May 13, 2025 (LPG Industry - CareEdge Report), the LPG under-recovery of Oil Marketing Companies (OMCs) for the first quarter of FY26 witnessed a sharp reduction of ~35% q-o-q. This reduction in under-recovery is essentially attributed to the price hike undertaken in April 2025 by Rs 50 per 14.2 kg cylinder, alongside some moderation in LPG sourcing cost.

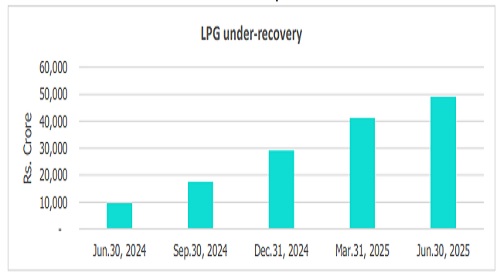

* The OMCs still faced under-recoveries of approximately Rs 7,940 crore in Q1FY26, down from Rs 12,110 crore in Q4FY25. This was mainly due to persistent differences between LPG sourcing costs and its revised retail prices. As a result, the total LPG under-recovery reached around Rs 49,210 crore by June 30, 2025, up from Rs 41,270 crore on March 31, 2025.

* In response to the growing burden of LPG under-recoveries, the Union Cabinet on August 08, 2025, approved compensation of Rs 30,000 crore for the OMCs, to be disbursed in 12 tranches. The exact modalities of the compensation are yet to be announced by the Ministry of Petroleum and Natural Gas (MoPNG), Government of India.

Declining Trend of LPG Procurement Cost

The Saudi Contract Price (Saudi CP), an international LPG benchmark, has sharply corrected recently due to geopolitical trade tensions, rising global production, weak demand, and seasonal slowdown after winter. It dropped to USD 506 per MT in August 2025 from over USD 600 per MT in March 2025.

In India, MoPNG, GoI regulates the retail prices of domestic LPG (subsidised and non-subsidised). After reducing the price by Rs 100 per 14.2 kg cylinder in March 2024, the price was revised upwards, effective April 08, 2025, by Rs 50 per cylinder. Furthermore, a reduction in LPG sourcing cost on the back of a decline in Saudi CP rates is expected to further reduce the LPG under-recoveries in the ensuing months.

Announcement of compensation package for OMCs

OMCs faced significant under-recoveries in LPG to the extent of ~Rs 220 per cylinder in FY25, as the higher LPG sourcing cost could not be passed on to the consumers.

With the twin impact of an increase in LPG retail prices by Rs 50 per cylinder and a moderation in sourcing cost, the LPG under recoveries have come down to ~Rs 160 per cylinder. While the LPG under recovery continues to build up, it reduced on a q-o-q basis by ~35% in Q1FY26. As of June 30, 2025, the cumulative under recovery mounted to ~Rs 49,210 crore. In a positive development, on August 08, 2025, the Union Cabinet announced a compensation package of Rs 30,000 crore towards under recoveries faced by OMCs, due to the selling of LPG at regulated prices. Lastly, OMCs had been compensated for LPG under-recoveries through subsidies from time to time, with a subsidy of Rs 22,000 crore provided in FY23 as well.

The 15-month Cumulative Balance of LPG Under-Recovery is Shown Below:

CareEdge Ratings’ View

“In response to the increasing burden of LPG under-recoveries, the Union Cabinet recently approved a significant compensation of Rs 30,000 crore for the OMCs, to be paid in twelve instalments. In April 2025, the Government of India raised the excise duty on fuel sales by Rs 2 per litre, which will now be passed on to the OMCs as compensation for LPG under-recoveries. While this compensation package will cover a substantial part of past under-recoveries, further accumulation is expected to slow down due to favourable trends in procurement prices. Although LPG under-recoveries strain the profitability of OMCs, they benefit from high marketing margins on petrol and diesel, which partially offset the overall financial impact. Overall, healthy compensation for LPG under-recoveries, rangebound crude oil prices, stable retail fuel prices, and potentially lower LPG sourcing costs augurs well for the OMCs,” said Richa Bagaria, Associate Director, CareEdge Ratings.

Above views are of the author and not of the website kindly read disclaimer