Commodity Research - Morning Insight - 08 Jan 2026 by Kotak Securities

Bullion – Spot gold slid about 1% and silver fell nearly 4% on Wednesday as a firmer US dollar triggered profit-taking, with upbeat US services data and resilient labor signals outweighing geopolitical risks. Additional pressure comes from near-term concerns that broad commodity index rebalancing may be weighing on bullions. The US ISM Services PMI surprised to the upside, rising to a 14-month high of 54.4, supporting steady economic momentum, even as ADP employment growth and JOLTS job openings pointed to some cooling in labor demand. Markets continue to price limited odds of an imminent Fed rate cut, though expectations for policy easing in 2026 remain intact. Today, Gold slipped near $4,440 as mixed U.S. data weighed, but central-bank buying, geopolitical risks, and 2026 Fed easing hopes persist; weaker jobless claims or NFPs may revive upside momentum.

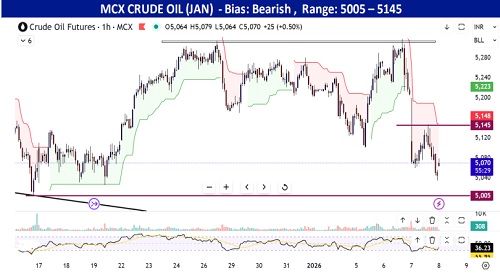

Crude Oil – WTI crude oil fell 2% on Wednesday at $56/bbl, pressured by expectations of additional supply as the US signaled it would control sales of sanctioned Venezuelan oil “indefinitely” while preparing to selectively roll back restrictions on the country’s crude exports. The prospect of incremental Venezuelan barrels has added to concerns of an already oversupplied global oil market. Further, Saudi Arabia cut the official selling price of its flagship crude for Asia in February for the third consecutive month, amid worries about weak demand and excess supply. Oil prices attempted a modest recovery today, edging higher to around $56.5/bbl, as traders assessed geopolitical risks in Venezuela and the Middle East. However, upside may be capped by a mixed EIA inventory report, which showed a 3.8 million bbl draw in crude stocks but a sharp build in refined product inventories.

Natural Gas – NYMEX gas futures rebounded from October lows to closed above $3.5/mmBtu, supported by a colder shift in weather projections for 2 nd half of January and a decline in US gas output.

Base metals –LME base metals ended the session on a weaker note, as investors locked in profits following a strong rally that had pushed prices to record highs earlier in the week. Copper fell nearly 3% to around $12,899/ton, while nickel and zinc also slipped close to 3%, tracking a broader pullback across the metals complex. The move was due to firmer U.S. dollar and caution ahead of a heavy slate of U.S. economic data that could shape the policy outlook of the Fed. Despite the near-term correction, the broader fundamentals remain positive. Earlier gains were driven by concerns that the Trump administration could impose tariffs on refined metals, diverting shipments into the U.S. and tightening supply in London and Shanghai. Meanwhile, supportive policy signals from the PBoC continue supporting longer-term demand from grid upgrades, renewables, and data-center expansion.

Please refer disclaimer at https://www.kotaksecurities.com/disclaimer

SEBI Registration No. INZ000200137