MCX Copper Jan is expected to rise towards Rs1325 level as long as it stays above Rs1290 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the positive bias and rise further towards $4650 level on softening of US treasury yields. Further, recent inflation data cemented bets on Federal Reserve rate cut this year. Fed is expected to hold rates steady at its January meeting but market is pricing 2 more rate cuts this year. Moreover, demand for safe haven may increase as geopolitical tensions remained elevated due to unrest in Iran, escalation in fighting between Russia and Ukraine and US renewed signals over taking control of Greenland after capture of Venezuela's President Nicolas Maduro. Furthermore, prices may rally on concerns over Fed independence. Additionally, US President Donald Trump threatened to slap 25% tariff on countries trading with Iran

* MCX Gold Feb is expected to rise towards Rs143,500 level as long as it stays above Rs140,500 level.

* MCX Silver March is expected to rise towards Rs283,000 level as long as it stays above Rs268,000 level. A break above Rs283,000 will open doors for Rs285,000 levels

Base Metal Outlook

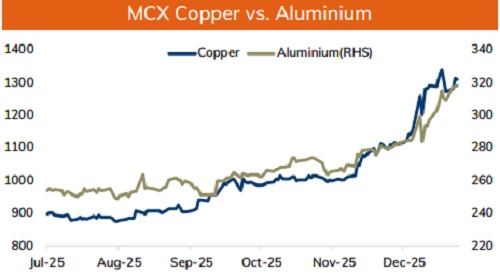

* Copper prices are expected to trade with a positive bias amid tightness in availability of LME copper inventories. It can also be seen in the rising premium on LME cash copper over the 3-month contract. Further, prices may rally on supply concerns as major South American miners continues to face disruption from natural disasters & strikes. Moreover, prices may move up on expectation of 2 more rate cut this year from US Fed and anticipations for further policy easing in top consumer China. Meanwhile, strong dollar and risk aversion in the global markets may weigh on copper prices

* MCX Copper Jan is expected to rise towards Rs1325 level as long as it stays above Rs1290 level. A break above Rs1325 level may open doors for Rs1330-Rs1340 level

* MCX Aluminum Jan is expected to rise towards Rs322 level as long as it stays above Rs314 level. MCX Zinc Jan is likely to face stiff resistance near Rs316 level and slip towards Rs310 level

Energy Outlook

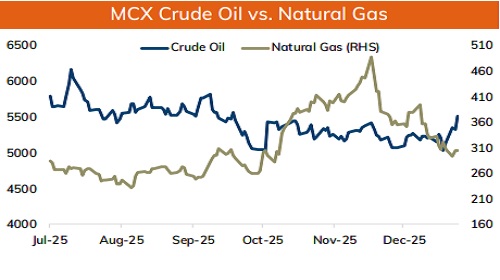

* NYMEX Crude oil is likely to trade with positive bias and rise towards $62 level on supply concerns. Investors fear that intensifying protest in Iran could disrupt supply. U.S. President Donald Trump threatened possible military action over lethal violence against protesters and said he has cancelled meetings with Iranian officials. Wider conflict with Iran may put oil shipment from Strait of Hormuz at risk. Additionally, investors are worried over supply disruption due to attacks on oil tankers in the Black Sea. Meanwhile, sharp upside may be capped as API data showed much larger build in US crude oil inventories. US Stockpiles rose by about 5.3M barrels for the week ended 9 th January

* MCX Crude oil Feb is likely to rise further towards Rs5600-Rs5650 level as long as it stays above Rs5350 level.

* MCX Natural gas Jan is expected to recover towards Rs320 level as long as it stays above Rs288 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631