MCX Natural gas Jan is expected to slip further towards Rs.280 level as long as it stays below Rs.310 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the positive bias and rise further towards $4620 level on weak dollar. Further, demand for safe haven may increase as geopolitical tensions remained elevated due to unrest in Iran, escalation in fighting between Russia and Ukraine and US renewed signals over taking control of Greenland after capture of Venezuela's President Nicolas Maduro. Further, uncertainty over tariffs persist as Supreme Court deferred on the legality of President Trump’s tariffs. Largest risk would be if the government is ordered to refund the tariff. Moreover, US President Donald Trump said he is ordering his representatives to buy $200 billion in mortgage bonds to bring down housing cost, seems like quasiquantitative easing

* MCX Gold Feb is expected to rise towards Rs.141,500 level as long as it stays above Rs.139,000 level.

* MCX Silver March is expected to rise towards Rs.261,000 level as long as it stays above Rs.252,500 level

Base Metal Outlook

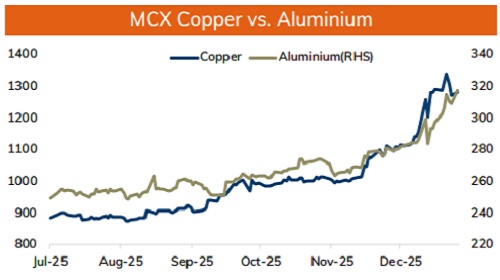

* Copper prices are expected to trade with a positive bias amid weak dollar and optimistic global market sentiments. Further, prices may rally on supply concerns due to mine disruptions and tight refined copper availability outside U.S. amid tariff uncertainties. Moreover, decline in inventories at LME registered warehouses would be supportive for the prices. Meanwhile, ongoing weakness in China’s construction sector could pose headwind for copper prices

* MCX Copper Jan is expected to rise towards Rs.1320 level as long as it stays above Rs.1265 level. A break above Rs.1320 level may open doors for Rs.1330-Rs.1340 level

* MCX Aluminum Jan is expected to rise towards Rs.323 level as long as it stays above Rs.314 level. MCX Zinc Jan is likely to face stiff resistance near Rs.312 level and slip towards Rs.307 level

Energy Outlook

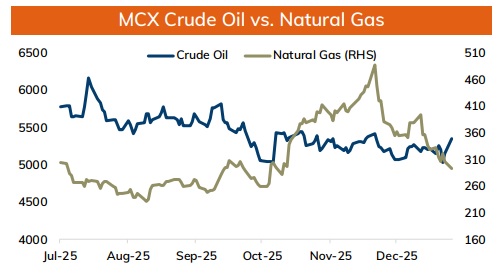

* NYMEX Crude oil is likely to trade with positive bias and rise towards $60 level on supply concerns and weak dollar. Investors fear that intensifying protest in Iran could disrupt supply. U.S. President Donald Trump has repeatedly threatened to intervene. Wider conflict with Iran may put oil shipment from Strait of Hormuz at risk. Additionally, Russian military fired its hypersonic missile targeting energy infrastructure supporting Ukraine's’ military industrial complex. Further, investors fears that Trump will allow a bipartisan sanctions bill targeting countries doing business with Russia. Moreover, prices may rally ahead of upcoming annual rebalancing of commodity indexes.

* MCX Crude oil Jan is likely to rise further towards Rs.5450-Rs.5500 level as long as it stays above Rs.5200 level.

* MCX Natural gas Jan is expected to slip further towards Rs.280 level as long as it stays below Rs.310 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631