MCX Crude oil April is likely to hold the support near Rs.5760 level and rise back towards Rs.5950 level - ICICI Direct

Bullion Outlook

* Gold is expected to correct back towards $2975 level on rise in US treasury yields. Yields are moving north on expectation that US Federal Reserve will keep its monetary policy untouched in upcoming meeting and Fed Chair Powell will reiterate that central bank is in no rush to resume rate cuts. Additionally, Fed policymakers will update their interest rate and economic projections this week, which may provide the sign of how central bankers view the likely impact of President Donald Trump's policies. Meanwhile, sharp fall may be cushioned on safe haven buying following escalating geopolitical tension in Middle East and ahead of talks between US President Donald Trump and Russian President Vladimir Putin. Spot gold is likely to face stiff resistance near $3010 level and slip back towards $2975 level. On contrary, a break above $3010 level prices may rally further towards $3020/$3040 level. MCX Gold April is expected to slip towards Rs.87,500 level as long as it stays below Rs.88,400 level.

* MCX Silver May is expected to rise back towards Rs.101,500 level as long as it trades above Rs.99,500 level.

Base Metal Outlook

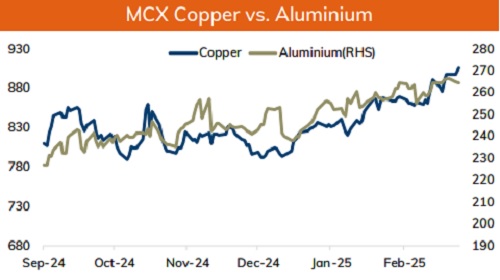

* Copper prices are expected to trade with positive bias on weakness in dollar, upbeat economic data from China and rise in risk appetite in the global markets. Further, prices may rally as Chinese government unveiled a special action plan aimed at boosting spending by increasing people’s incomes, reinforcing optimism for stronger industrial demand. Additionally, top supplier Codelco warned that production this quarter will be similar or slightly below year ago levels due to maintenance work. Meanwhile, all eyes will be on major central banks monetary policy, where they are widely expected to hold fire until the consequences of US President Donald Trumps multi-front tariff war can be evaluated

* MCX Copper March is expected to rise further towards Rs.915 level as long as it stays above Rs.895 level. A break above Rs.915 level prices may rally further towards Rs.920 levels

* MCX Aluminum March is expected to rise back towards Rs.268 level as long as it stays above Rs.263 level. MCX Zinc March is likely to move back towards Rs.282 level as long as it stays above Rs.278 level

Energy Outlook

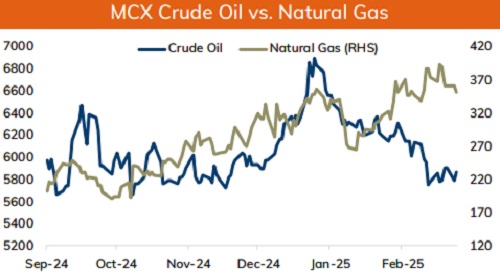

* NYMEX Crude oil is expected to trade with positive bias and rise further towards $68.50 level on weakness in dollar and rise in risk appetite in the global markets. Further, prices may move north on supply concerns as US vowed to attack Yemen Houthis until the group ends its assaults on shipping. Additionally, investors will remain cautious ahead of talks between US President Donald Trump and Russian President Vladimir Putin aimed at ending the Ukraine war. Moreover, prices may rally on expectation of revival in Chinese economy after Beijing announced new measures to boost consumption. Meanwhile, market will keep an close eye on economic data from US to gauge economic health of the country

* MCX Crude oil April is likely to hold the support near Rs.5760 level and rise back towards Rs.5950 level. A break above Rs.5950 prices may rise further towards ?6050 level.

* MCX Natural gas March is expected to slip further towards Rs.340 level as long as it stays below Rs.365 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631