MCX Natural gas Jan is expected to recover towards Rs330 level as long as it stays above Rs 300 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the positive bias and rise back towards $4500 level on softening of US treasury yields across curve. Further, recent batch of economic data showed weakness in labor market condition, strengthening bets of Federal Reserve rate cut. Additionally, demand for safe haven may continue to rise on escalating geopolitical tension. US has seized Russian-flagged vessel in North Atlantic linked to Venezuelan oil. Furthermore, White House separately confirmed discussions about acquiring Greenland, including potential military involvement. Moreover, prices may rally on strong central bank demand for gold. China's central bank extended its gold-buying streak to a 14th straight month in December

* MCX Gold Feb is expected to rise back towards Rs 139,000 level as long as it stays above Rs 137,000 level.

* MCX Silver March is expected to slip towards Rs 245,000 level as long as it stays below Rs 254,000 level

Base Metal Outlook

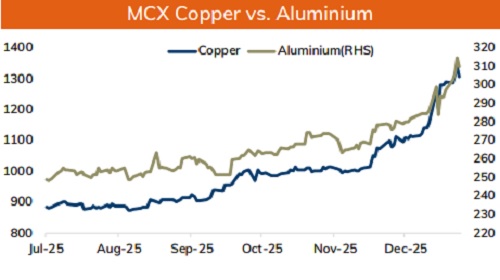

* Copper prices are expected to trade with a negative bias amid strong dollar, risk aversion the global markets and rise in inventories at LME registered warehouses. Further, prices may slip on weak demand from China. The Yangshan copper premium, a gauge of Chinese consumers' appetite for imported copper, declined to $39 a ton, down from above $50 by the end of 2025. Meanwhile, sharp downside may be cushioned on supply concerns amid series of mine disruption and recurring protest.

* MCX Copper Jan is expected to slip towards Rs 1290 level as long as it stays below Rs 1330 level. A break below Rs 1290 level may open doors for Rs 1280-Rs 1270 level

* MCX Aluminum Jan is expected to slide towards Rs 305 level as long as it stays below Rs 315 level. MCX Zinc Jan is likely to face stiff resistance near Rs 314 level and slip towards Rs 306 level

Energy Outlook

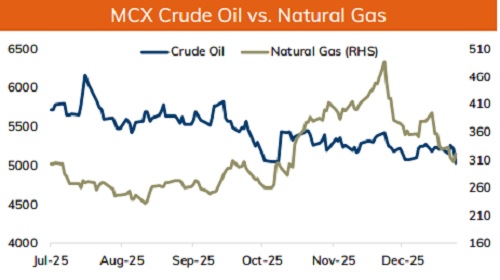

* NYMEX Crude oil is likely to trade with negative bias and slip further towards $55.5 level on strong dollar and pessimistic global market sentiments. Further, prices may move south as US President Donald Trump’s plan to refine and sell Venezuelan crude oil raised concerns about the long-term impact of the U.S. actions. Investors fear that if the oil from Venezuela flows into the market sustainably then it could add supply to an already oversupplied market. Moreover, EIA data showed rise in gasoline and distillate stockpiles, signaling weak fuel demand. While, crude oil inventories decreased by about 3.8M barrels for the week ending 2 nd January 2026

* WTI crude oil prices may move lower towards $55.5 level as long as it stays below $57.20 level. MCX Crude oil Jan is likely to slip further towards Rs 5000-Rs 4980 level as long as it stays below Rs 5200 level.

* MCX Natural gas Jan is expected to recover towards Rs330 level as long as it stays above Rs 300 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631