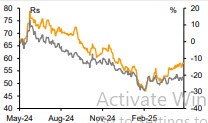

Add Motherson Sumi Wiring India Ltd For Target Rs. 60 By Emkay Global Financial Services Ltd

Key beneficiary of EV shift; greenfield ramp-up to aid margins

We visited MSUMI’s recently operationalized plant in Pune and met the management as well. KTAs: 1) The new greenfields would cater to ICE and EV programs of marquee SUV-focused OEMs like M&M, TTMT, and even MSIL. 2) On full ramp-up, these greenfields (as OEM volumes scale-up) can contribute Rs21bnpa revenue (23% of FY25 revenue). 3) Higher localization (particularly in EV components) as well as scale-up (better man-power productivity) would aid margin expansion. 4) MSUMI is a key beneficiary of the secular content growth led by premiumization (1.5x higher content in SUVs vs Sedans) and electrification shift (1.75-2x higher content in E-PVs) 4). We believe MSUMI‘s superior revenue growth and strong order wins indicate improving competitive positioning. However, margin expansion will be driven by improved utilization of these greenfields which in turn will be dependent on the success of key customer OEM EV models. Our estimates are unchanged; we maintain ADD with TP of Rs60 at 28x FY27E PER.

Significant traction with marquee SUV-focused OEMs, including EVs

MSUMI supplies to 9 of the top-10 popular PV models in India, and is setting up three new greenfields to support future growth (Pune-already commissioned; Gujarat to be commissioned in H1FY26; Haryana to operationalize in Q2FY26). These greenfields are for new EV and ICE programs (not for replacements/midcycle updates) of marquee SUV focused OEMs like M&M, TTMT, and MSIL. MSUMI anticipates that on full ramp-up (ie achieving target volume committed by OEMs), these greenfields could contribute Rs21bnpa revenue. It expects these facilities to achieve optimal utilization by H2, which should help alleviate the current margin drag.

Higher localization and scale up to drive margin expansion

Current losses from greenfields are largely due to two greenfields yet to operationalize; reported numbers reflect manpower cost related to the plant already commissioned and partial manpower hiring at the other two plants; the company expects staggered addition of manpower, depending on how volume/scale-up at greenfields evolves. It remains committed to localization of high and low voltage harnesses, and has localized a few high voltage harnesses, charging connectors, etc; Import content is initially high at launch although it tapers down over time and localization imparts ~15-20% cost benefit. Higher localization/scale-up (improved man-power productivity) to drive margin uptick.

Ou view – MSUMI offers a compelling play on PVs; major beneficiary of EV shift

We believe MSUMI presents a compelling play on the PV segment, driven by wallet share gains through new model additions and secular content growth tailwinds led by sustained premiumization (rising SUV mix; 1.5x higher content in SUVs vs Sedans) and on-going electrification trend (1.75-2x higher content in E-PVs vs ICE counterparts). We believe that while MSUMI’s strong revenue growth (4% revenue outperformance vs key client MSIL in FY25) and order wins reflect improving competitiveness, margin expansion hinges on greenfield ramp-up which is tied to the success of key OEM EV programs.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)