Buy Maruti Suzuki Ltd For Target Rs. 13,300 By JM Financial Services

Below estimate; Near term pressures to continue

MSIL’s 4QFY25 EBITDA margin came in at 10.5%, 150bps below JMFe. New plant-related costs, higher administrative / advertisement expenses and unfavourable product mix impacted profitability. MSIL’s retail vol. during 4Q grew by 4% YoY. Challenges continue to prevail in the compact and entry-level segment. We are factoring in 3.8% / 6.3% volume growth in FY26E / FY27E. Double-digit growth in exports (starting of e-Vitara, and Jimny) is expected to provide a cushion against the slowdown in domestic demand. MSIL plans to launch two new models in FY26: e-Vitara and a new SUV. Commodity headwinds, new plant-related expenses and addition of EV in the portfolio will likely be a drag on margins. We have cut our revenue growth estimates from 16% / 11% to 8% / 10% in FY26E /FY27E. We have also reduced our EPS estimates by 11% / 12% for FY26E / FY27E from our previous estimates. We ascribe 24x PE to arrive at Mar’27 fair value of INR 13,300. Maintain BUY.

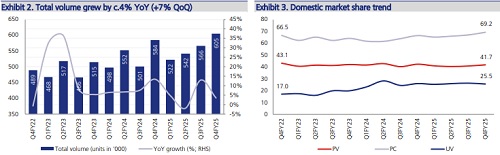

* 4QFY25 - Margin below estimate: MSIL reported net revenue of INR 407bn (+6% YoY, +6% QoQ), c.5% below JMFe. 4Q wholesales stood at c.604.6k units (+4% YoY, +7% QoQ). Realisation increased by c.2% YoY (-1% QoQ). EBITDA margin came in at 10.5% (- 180bps YoY, -110bps QoQ), 150bps below JMFe. Reported PAT stood at INR 37bn (- 4%YoY, +5% QoQ).

* Demand environment: The company highlighted that retail sales during the quarter grew by c.4% YoY. MSIL’s retail market share stands at c.41% and it aims to improve it gradually. Management also indicated that retails in rural region continued to grow faster than urban during 4Q. Dealer inventory stood at 28 days as on Mar’25 end. While the company remains cautious on domestic PV industry outlook due to subdued demand and affordability challenges in the entry-level segment, it expects to outperform the industry in FY26. With respect to exports, MSIL continued to maintain a healthy growth momentum. The management indicated that the company is unlikely to be impacted by global uncertainty, given it does not export to the U.S., and expects exports to grow by 20% YoY in FY26. Medium-term target is to grow export vols. by 3x by FY31.

* New launches: MSIL plans to launch two new models in FY26- the e-Vitara and a new SUV. Sales for the e-vitara are scheduled to commence in 1HFY26. The company targets to sell 70k units during the year, driven largely by exports. MSIL indicated that all its models will be equipped with 6 airbags from FY26 onwards. Additionally, it is also working towards an entry-level hybrid car.

* Margin outlook: MSIL’s EBITDA margin declined by 110bps QoQ to 10.5%. This was due to new plant-related expenses (30bps), unfavourable product mix (40bps), elevated advertisement expenses (30bps), adverse commodity prices (20bps) and higher other expenses (90bps), partially offset by lower sales promotion expenses (40bps) and favourable operating leverage (40bps). MSIL sources majority of its steel requirements locally and does not expect any impact of safeguard duty. Further, it has announced price hike from Apr’25 onwards. However, commodity headwinds, new plant-related expenses and addition of EV in the portfolio will likely be a drag on margins.

* Other highlights: 1) CNG penetration for MSIL declined to 33.7% in 4QFY25 from c.36% in 3QFY25. 2) Capex for FY25 stood at INR 84bn, and the company has guided for a capex of INR 80-90bn in FY26 (including SMG). 3) The first phase of capacity addition (250k units) at the Kharkhoda plant was operationalised in Mar’25.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361