Buy Maruti Suzuki India Ltd For Target Rs. 13,500 By Emkay Global Financial Services

We upgrade MSIL to BUY from Add while revising up our TP by 5.5% to Rs13,500 at 25x core Mar-27E PER (rolled-over) despite a muted near-term PV industry environment. Notably, new launches have historically driven volume growth in PVs; MSIL’s launch cycle turns positive in FY26E (vs a muted industry launch pipeline) with 2 major upcoming ICE SUVs (5-seater likely in Sep-25E; 7-seater likely in Jan-26E; combined production of ~18-20K/mth per industry checks; we factor in 12K units/mth), apart from the recently unveiled E-Vitara electric SUV. This coincides with early signs of improvement seen in small cars (2% growth in Dec-Jan after ~3Y of decline) with potential consumption boosts (recent tax cuts, 8th Pay Commission) providing further optionality; however, sustenance of such improvement needs to be watched. We build in ~8% FY25E27E volume CAGR, with 12.5% margin by FY27E vs 11.6% in Q3, on higher share of SUVs; EPS CAGR is 13% (FY26E/27E EPS, in line with/5% below Consensus. Risk-reward is favorable, with 1YF valuations near 1SD below LTA.

Two new ICE SUVs in FY26E; strong volume visibility, per industry checks

MSIL’s upcoming launches ICE SUV launches (5-seater likely from Sep-25E, and 7-seater likely in Jan-26E) provide greater growth visibility as against the muted PV industry pipeline. Per our industry checks, there are indications of significant ~18-20K/mth volumes from the 2 SUVs (we factor in 12K). This, along with the upcoming electric SUV E-Vitara (10-12K units/mth as per checks led by exports, leveraging Toyota’s distribution network), drive 5%/8% upgrade in FY26E/27E revenues. We also draw comfort from MSIL’s aggressive long-term growth intent, ie 1) near-doubling of capacity to ~4mn units pa by 2030, 2) 9 model launches by 2028 (per media reports), 3) ambition to reclaim 50% market share apart from enhanced exports focus (targets 3x volumes by 2030), and 4) work under way on BEVs (4 planned launches by 2030), aided by collaboration on a common EV platform with other Japanese players, to ensure cost efficiencies.

Small car decline narrowing; sustainability needs to be monitored

Small cars are showing early signs of improvement (2% growth in Dec-Jan, after ~3 years of decline); Wagon R, one of MSIL’s power brands, has seen 3 months of growth. We believe potential consumption boost from the recent tax cuts and 8th Pay Commission payout could be further enablers; however, sustenance of such improvement needs to be watched. Parent Suzuki has also announced its intent to revive interest in the segment, with launch of a new model in coming years. MSIL would be an outright beneficiary of small car recovery owing to its lion’s share in the segment (~67% as of FY25YTD).

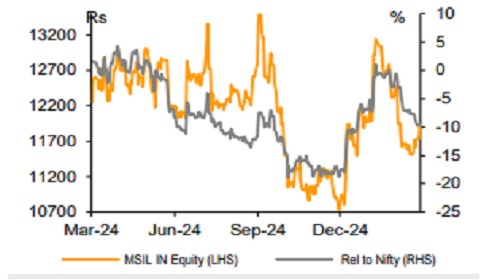

Risk-reward attractive; valuations below LTA

MSIL managed its Q3 profitability well, at 11.6% (vs 150bps decline at HMIL), despite discounts being at record high levels. We believe a richer SUV mix would help drive margin improvement to 12.5% by FY27E (though partially negated by EVs); FY25E-27E core EPS CAGR stands at 11%. We believe valuations at 21x Mar-27E PER are attractive; at CMP, MSIL trades near 1SD below its LTA from a 10-year perspective.

1-Year share price trend (Rs)

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)