Buy DCB Bank Ltd For Target Rs. 150 By JM Financial Services

Strong quarter; upgrade to Buy on benign valuations

In 4QFY25, DCB Bank reported a healthy performance with PAT growing (17% QoQ, +14% YoY) driving RoA/RoE of ~0.95%/13% led by a) strong advances growth of 25% YoY; b) broadly stable margins (reported) driving steady NII (+10% YoY); c) strong momentum in fee income (+14% QoQ) and d) tight control on credit costs at 0.6% (flat QoQ). Deposits grew 22% YoY, despite a challenging environment for deposit mobilization. Bank undertook proactive rate cuts in both SA/TD following the repo rate reduction. However, mgmt. still highlighted that any further rate cuts could adversely impact margins, as bank is unlikely to fully pass on lower rates to depositors given rising competitive intensity. To mitigate this pressure, bank is focused on maintaining strong fee income growth, which will be crucial in supporting return metrics going forward. Asset quality trends improved, with gross slippages/net slippages moderating to ~3%/0.5% (-47bps QoQ, -39bps QoQ). We expect bank to deliver strong loan CAGR of ~21% over FY25–27E with benign credit cost of ~60bps on account of minimal exposure to the unsecured segment. We revise our EPS estimates upwards by ~20% over FY26E–27E and build in average RoA/RoE of 0.87%/13.1% over the same period. Given expected growth/return profile, current valuation of 0.6x FY27E BVPS, offers a favourable risk-reward profile, in our view. We upgrade the stock to BUY, with a revised target price of INR 150 (from INR 125 earlier), valuing the bank at 0.7x FY27E BVPS.

* Strong loan growth; focus remains on liability franchise: In 4QFY25, advances grew at a robust pace (+25% YoY, +7% QoQ), led primarily by strong traction in retail banking (+17% QoQ), followed by the commercial vehicle segment (+15% QoQ) and Agri book (+6% QoQ). Management highlighted that slippages in the MFI book have yet to show signs of improvement; however, given its relatively small share in the overall portfolio, they remain unconcerned at this stage. Despite a challenging environment for deposit mobilization, deposit growth remained healthy at (+22% YoY, +6% QoQ), with term deposits (+7% QoQ) leading the momentum, followed by CASA deposits (+4% QoQ). While management is currently comfortable with the CD ratio, they reiterated that, over the long term, their strategic focus will remain on growing the liability franchise at a faster pace than advances. We build in a loan/deposit CAGR of 21% over FY25–27E.

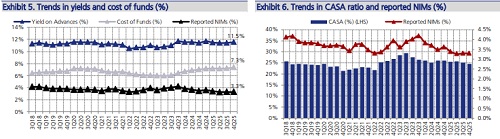

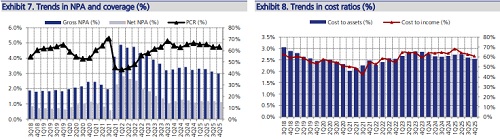

* PPoP beat led by strong fee income: Operating profit came in ahead of expectations (+13% QoQ, +31% YoY, +23% JMFe), driven by a) steady NII growth (+3% QoQ) and b) strong momentum in fee income (+14% QoQ, +36% YoY). As a result, non-interest income remained robust (+19% QoQ). Bank's continued investments in technology and focus on productivity are beginning to yield results, with cost-to-assets moderating to 2.5% (vs 2.6% QoQ). Return metrics also saw an improvement, with RoA rising to approximately ~1.0% (vs 0.9% QoQ). Reported NIMs remained largely stable (–1bps QoQ), supported by proactive efforts to manage CoF. However, mgmt. expects margin pressures to persist in the near term.

* Stable asset quality metrics: Gross slippages and net slippages moderated to 2.96%/0.51% (-47bps QoQ, -39bps QoQ), while credit costs remained steady at 0.6% (flat QoQ). Despite broader industry headwinds on asset quality, bank has managed to navigate the environment well, supported by its negligible exposure to the unsecured segment. Backed by its conservative approach to lending, mgmt. remains confident in keeping credit costs contained within the ~45–55bps range going forward. We build in avg, credit costs of 0.6% over FY26E-27E.

* Valuation and view:

Though margins are expected to remain under pressure in the near term, DCB Bank continues to trade at attractive valuations of 0.6x FY27E BVPS, offering a favourable risk-reward profile. We expect bank to deliver strong loan CAGR of ~21% over FY25–27E with benign credit cost of ~60bps on account of minimal exposure to the unsecured segment. Given the improving operating performance and stability in asset quality, we revise our EPS estimates upwards by ~20% over FY26E–27E and build in average RoA/RoE of 0.87%/13.1% over the same period. We upgrade the stock to BUY, with a revised target price of INR 150 (from INR125 earlier), valuing the bank at 0.7x FY27E BVPS.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361