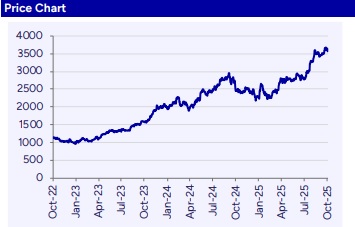

Accumulate TVS Motor Company Ltd for the Target Rs. 3,907 By Prabhudas Liladhar Capital Ltd

Margin expansion aided by PLI benefits

TVS Motor Company reported a decent set of numbers for Q2FY26, delivering margin expansion, aided by the recognition of PLI, improved mix, price increases and cost reduction. Standalone operating revenue grew by 29.0% YoY, supported by a 5.1% increase in ASP which was broadly in-line with BBGe and 3.6% above PLe. This resulted in gross margin expanding by 50bps YoY by and 10bps QoQ even as commodity costs increased slightly. EBITDA grew by 39.7% YoY with EBITDA margins expanding by 100bps YoY to 12.7%. Normalized EBITDA margin adjusted for the PLI benefit was ~12.2% (+50bps YoY) that was partially dragged down by higher other expenses. Reported PAT grew by 36.7% YoY, missed BBGe by 4.7% (met PLe) due to a loss on fair valuation of an investment held by the company.

We expect its Revenue/EBITDA/EPS to grow at a CAGR of 15%/18%/21% over FY25-28E and retain our “ACCUMULATE” rating with a TP of Rs3,907 (including Rs 81 for TVS Credit), valuing its core business at a P/E of 45x on its Sep’27E EPS.

Domestic 2W ICE industry grew by 2% YoY in H1’26: The management expects it to grow by 8% in H2’26 YoY even on a higher base, with TVS outperforming in all segments. Exports market is expected to continue to do well and e2W market to grow. Scooters have been growing faster than industry and the premium & executive segments are doing well. Economy segment has also started moving up and is expected to improve going ahead.

Rare earth constraint could affect margins adversely: Rare earth magnet availability continues to pose challenge in the short-to-medium term for TVS, and higher EV penetration is expected to slightly drag the margins down. Better exports mix and a weaker Rupee is expected to be a tailwind to the revenue. We believe TVS is well placed to outperform the industry, and we slightly tweak our estimates to incorporate the beat on ASP, margin expansion and management commentary.

Conference Call Highlights

* In Q2’26, 2W domestic ICE sales for TVS grew by 21% (industry grew by 8%), 2W international sales grew by 31% (industry grew by 26%) YoY. Total 2W ICE sales of TVS grew by 23% while the industry grew by 11%

* For the Dusshera-Diwali festive season, as per Vahan sales Industry grew by 24% (rural grew by 22%, urban by 26%) while TVS grew by 32% YoY

* Had it not been for the rare earth magnet constraints the industry and TVS’ EV sales would have grown higher

* EBITDA margin of 12.7% in Q2FY26 includes PLI benefits of ~Rs0.6bn, excluding which the normalized EBITDA margin improved by ~50bps YoY to 12.2%. PLI benefit of Rs 2.1bn for the whole FY25 was received in Q4’25 itself. The management expects scale, premiumization, improved product mix and cost reduction to help EBITDA improve going forward. TVS has started getting PLI benefit for almost all products

* Other expenses: variable costs, packing and freight had gone up due to festive season (should normalize in coming quarters). Marketing expenses were also higher for new launches

* The management expects domestic 2W ICE industry in H2’26 to grow by 8% YoY even on a higher base. With better monsoon, GST2.0 impetus and infra investments, it expects rural growth to catch-up with urban growth

* The management expects very small increase in commodity costs sequentially in the next quarter, but it will be lower than the 0.6% increase that was seen for Q2

* EVs are loss making at EBITDA level although contribution margins are positive for TVS, but with improved scale margins will also go up. EV penetration for the quarter was 7.8% (mainly from urban market) and EV revenue was Rs12.69bn. Sales in rural market has recently started and is expected to grow, iQube crossed 700k sales in domestic market. Vahan share in e-3W already crossed 11% (almost doubled YoY) and the company aspires to be prominent in e-3W like in e-2W

* International business: saw strong growth in major markets. Demand in Africa, Sri Lanka and Nepal is growing sequentially along with strengthening network in Bangladesh. Strong demand has been seen in many LatAm markets as well where TVS is a nascent player but will keep growing ahead of industry, expecting to become a prominent player in coming time. Exports revenue for the quarter was Rs28.85bn. Exports penetration will continue to grow as aided by EV exports

* Inventory levels have been around 25 days, with some shortage seen in production and supply of EVs due to REM constraints

* Revenue from spares for the quarter was Rs10.7bn (+15% YoY), contributing 9% to the operating revenue

* Recent new launches include TVS Orbiter (EV scooter), Ntorq 150 (hypersport scooter), Apache RTX (Adventure rally tourer) & limited-edition variants of Apache, and King Kargo HD EV (focused on urban logistics). All these models are garnering good customer interest

* The full range of Norton super-premium category bikes will be revealed at EICMA next week in Milan and in Europe it has already started distribution planning. Launch in India is expected by Apr’26 and will follow differentiated strategy and superior experience.

* TVS Credit Ltd’s book size as of Q2’26 was Rs278.07bn (Q1’26: Rs269bn) and the customer base was more than 2.13Cr (Q1’26 at 2.1Cr). Its PBT for Q2’26 grew by 28% YoY to Rs2.77bn

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271