Accumulate Jyothy Laboratories Ltd For Target Rs. 450 By Elara Capital Ltd

Steady volumes in a challenging market

Jyothy Labs (JYL IN) recorded a 7% volume growth in 9MFY25, outperforming most large FMCG peers. However, near-term growth may remain subdued due to demand challenges in urban markets. Despite this, the company's strong positioning in the affordable segment and ongoing distribution expansion are expected to drive sustained volume growth ahead of industry peers in the long term. We retain Accumulate with a lower TP of INR 450 based on 38x FY27E P/E.

Growth driven by fabric care:

JYL reported a revenue growth of 4% YoY to INR 7bn in Q3, in-line with our estimates, with 8% YoY volume growth. The value-volume gap resulted from increased grammage and promotional price-off in key categories such as dishwash and liquid detergent. Urban (60% of sales) continued to be weak for JYL as well, which more than offset the better performance in rural. The growth was led by fabric care segment, up 9.3% YoY, aided by strong growth in the liquid detergent. Dishwashing segment, up 3.6% YoY, was driven by double-digit growth in the liquid portfolio. Household insecticides (HI) segment declined 24.7% YoY due to unfavorable weather and consumers downgrading to incense sticks, though liquid vaporizers saw double-digit growth in 9MFY25. Personal care fell 3.6% YoY on a high base and downtrading to mass segments. JYL implemented a low single-digit price hike in soaps as at Q3-end, set to reflect in Q4.

Innovation to strengthen mass segment:

JYL is committed to driving growth through innovation, distribution expansion, and increased brand investment. In fabric care, the company strengthened its portfolio by expanding Mr. White into liquid detergent range, reinforcing its focus on innovation and catering to diverse price segments. Recognizing opportunities in the mass toilet soap category, JYL introduced Jovia beauty soap in two competitively-priced variants to address portfolio gaps and align with shifting consumer preferences towards affordable beauty soaps. Additionally, in the HI segment, the company launched the Maxo Anti-Mosquito Racquet to enhance its product offerings. While near-term growth may remain subdued, JYL is focused on achieving long-term double-digit volume growth.

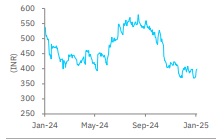

Price chart

Profitability impacted by higher operating expenses:

EBITDA margin contracted 110bps YoY to 16.4%, below our estimates of 17.5%, dragged down by higher operating expenses (up 65 bps YoY) due to higher freight cost. With rising palm oil prices, JYL is looking at additional price hikes in Q4. The management retained its EBITDA margin target of 16-17% in the near term, anticipating continued high advertising spend.

Reiterate Accumulate with a lower TP of INR 450:

We cut our EPS estimates by 9-10% for FY26E and FY27E to factor in lower revenue and margin. So, we pare our TP to INR 450 from INR 520, on 38x (from 40x amid muted demand scenario) FY27E P/E as we roll forward. JYL’s affordable price point positioning, new launches and distribution expansion would drive volume growth ahead of peers – Reiterate Accumulate.

Please refer disclaimer at Report

SEBI Registration number is INH000000933