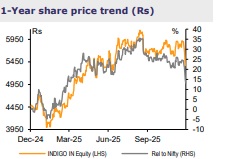

Buy InterGlobe Aviation Ltd for the Target Rs.6,300 by Emkay Global Financial Services Lt

The unprecedented crisis has led to >4,200 cancellations for Indigo in the past 8 days – which is 23% of the 2,300+ daily flights the airline was scheduled to clock in Dec-25. Operations have improved in the last few days, with relatively low ~530 cancellations on 8-Dec; Indigo expects normalization from 10-Dec, though the situation is still evolving wrt GoI action, if any, on the company (response to the show cause notice filed by the airline; DGCA probe under way) and regarding its hiring plans for meeting the crucial FDTL norms by 10-Feb-26 which will be reimposed thereafter. As of now, we estimate a 3%/8%/17% cut in FY26E revenue/EBITDA/ex-forex PBT due to a 2% impact each on volume and yield, along with some increase in CASK. We lower the target P/E from 23x to 22x and cut TP by >7% to Rs6,300. While Indigo runs the risk of lost reputation and regulatory support, its position in the Indian aviation market is vital and quick normalization of operations should revive the momentum. A penalty could be a near-term action by the GoI; Indigo may also be directed to further compensate the affected parties. GoI may want to bring in more players, though the global aviation supply-chain scenario remains challenging; BUY.

Crucial FDTL norms with other headwinds lead to December breakdown The crucial FDTL norms; namely i) increase in weekly rest from 36 to 48 hours, ii) night duty limits from 0000 to 0600 and a night pilot only permitted two landings in the following 24 hours, and iii) not more than two consecutive nights of duty coupled with winter schedule demands, weather disruptions, congestion, and software issues led to a cascading effect, with Indigo compelled to take a complete reset of operations with >1,600 cancellations on 5-Dec. The DGCA has put these on abeyance currently (for the A-320 fleet) till 10-Feb-26 and has included leaves in the 48-hour resting period.

Near-term volumes to be impacted; awaiting more details on full recovery Indigo targets normalization from 10-Dec, though reaching the pre-crisis daily flight level of >2,300 is unclear, with the more likely number at >2,000 flights as of now. We estimate ~4,800 cancellations during 1-10 Dec and 2,100 flights/day for the remaining month; this implies a ~4% volume impact for Q3FY26. Hence, 16-17% ASK growth YoY guided earlier reduces to 12-13%, while RPK growth is likely to be 11-12%. Q4FY26 ASK growth could be ~2% lower at 14-15% vs high-teens growth guided earlier. PRASK guidance for Q3FY26 was flat-to-slightly up YoY earlier, but now, per our checks, could be mildly down. Oct-25 was strong, while Nov was more moderate and Dec volatile.

CASK to rise from new pilot hiring and current incidentals; fuel prices to subside Per the filings, there was shortage of 65 captains and 59 co-pilots in Nov which led to the crisis. Per media reports, Indigo aims to induct 158 pilots by Feb-26 and another 742 by Dec-26. The FDTL impact could lead to a 6-7% rise in pilot salary cost or Rs0.01/ASK. The entire crisis has led to incidentals like customer (9,500 hotel rooms during 1-7 Dec) and crew accommodation and conveyance (10,000 cabs/buses for customers), baggage tracking and delivery (4,500), etc which would add to the Q3 CASK.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)

2.jpg)