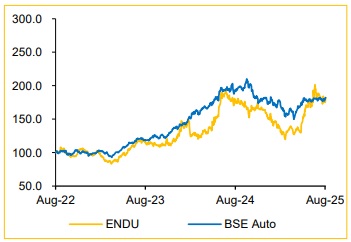

Reduce Endurance Tech Ltd for the Target Rs.2,530 by Choice Broking Ltd

Significant Opportunity in ABS Market:

New safety regulations in India, effective January 2026, mandate 100% Anti-lock Braking System (ABS) use for two-wheelers above 50cc and all two-wheeler EVs greater than 4kW motor power. This is projected to increase ABS requirements five-fold, presenting a big opportunity for ENDU, targeting a 16Mn-unit market. The company is aggressively expanding its capacity from 640,000 units to 3 million units by March 2026, targeting at least a 25% market share. We expect ENDU to capitalize significantly on this regulatory tailwind, given the aggressive capacity buildup translating into substantial revenue and market share gains from FY26 onwards, as it is uniquely placed to meet the anticipated surge in demand.

View and Valuation: We revise our FY26/27 EPS estimates by 1.5%/(0.3)% and arrive at our target price of INR 2,530. We value the company at 28x (previously 25x), taking in account the capacity additions and acquisitions, on the average FY27/28E EPS, while we introduce FY28 estimates. Consequently, we maintain our ‘REDUCE’ rating, given the limited upside on the stock.

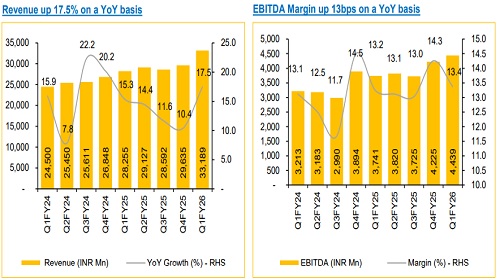

Revenue slightly better, EBITDA margin lower compared to expectations

* Revenue was up 17.5% YoY and up 12.0% QoQ to INR 33,189Mn (vs consensus est. at INR 31,139Mn).

* EBITDA was up 18.7% YoY and up 5.1% QoQ to INR 4,439Mn (vs consensus est. at INR 4,326Mn). EBITDA margin was up 13bps YoY and down 88bps QoQ to 13.4% (vs consensus est. at 13.9%).

* APAT was up 11.0% YoY and down 2.8% QoQ to INR 2,264Mn (vs consensus est. at INR 2,329Mn).

Profitable European Operations and Strategic Acquisitions:

ENDU's European operations demonstrated strong performance in Q1FY26, with a 28.5% YoY revenue growth. Excluding the acquisition impact, revenue grew 0.6% despite a decline in new car sales in Europe. The strategic acquisition of a 60% stake in Stoeferle has significantly contributed to this growth, adding EUR 22Mn to the topline in Q1FY26. Stoeferle exhibits high profitability (18.7% EBITDA margin) and the acquisition facilitates critical synergies by enabling ENDU to internalize component production previously outsourced.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131