Nifty & Bank Nifty Weekly Outlook 29 June 2025 by Choice Broking Ltd

NIFTY WEEKLY OUTLOOK

Benchmark indices extended their winning streak for the fourth consecutive session on Thursday, June 27. The Nifty 50 touched a high of 25,650, supported by broad-based buying, as market participants cheered the possible extension of the Trump tariff deadline and rising hopes of a sooner-than-expected US Fed rate cut. These developments lifted overall sentiment across global markets, with Indian equities joining the rally.

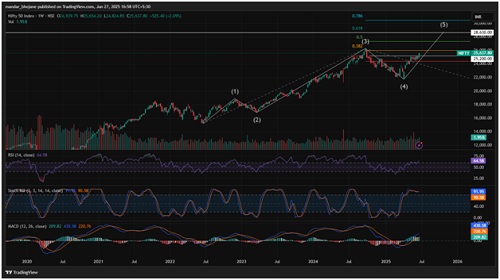

From a technical perspective, the Nifty is trading in Wave 5 of an impulse pattern on the weekly chart, signaling continued bullish momentum. The index has given a breakout from its recent consolidation range, forming a strong bullish candle. According to Fibonacci extension levels, the projected targets for this 5th wave stand at 27,300 and 28,600. On the downside, immediate support is seen at 25,000 and 24,500, where any correction could be viewed as a buy-on-dips opportunity. The RSI stands at 64.58, trending upward, indicating continued strength in momentum.

Meanwhile, India VIX declined by 1.61% to 12.3875, suggesting cooling volatility and reduced near-term fear among market participants. In the derivatives space, heavy Call writing at 26,000 and Put support at 25,500 indicates a defined short-term trading range for the Nifty between 25,500 and 26,000.

Support Levels: 25200-25000

Resistance Levels: 27000-28000

Overall Bias: Bullish

BANKNIFTY WEEKLY OUTLOOK

Bank Nifty hit a record high above 57,400 this week, closing with strong gains for the fourth consecutive session. The index showed solid momentum, backed by broad-based buying in both private and PSU banks. Positive global cues such as hopes of an extension in the Trump tariff deadline and increasing expectations of a US Fed rate cut further fueled the rally in banking stocks. The strong participation from heavyweights like HDFC Bank, SBI, and ICICI Bank added to the bullish sentiment.

Technically, Bank Nifty is trading in the 5th wave of an impulse pattern, consistently forming higher highs and higher lows on the weekly chart. A breakout from the recent consolidation range was confirmed with rising volume and a bullish weekly candle. The RSI at 67.3 indicates continued upward momentum but is approaching the overbought zone, signaling the need for caution. As per Fibonacci extension levels, the next potential upside targets lie at 58,700 and 60,000, while immediate support is placed near 56,700. Dips towards support levels can be seen as buying opportunities in this strong uptrend.

In the derivatives segment, aggressive call writing at 60,000 and strong put base at 55,500–56,000 reflect a well-defined trading range and growing confidence among traders. Additionally, India VIX cooled off by 1.61% to 12.38, showing reduced fear and supporting a continuation of the rally in the near term.

Support Levels: 57000-56700

Resistance Levels: 58500-59000

Overall Bias: Bullish

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131