Buy National Aluminium Company Ltd for the Target Rs. 281 By Prabhudas Liladhar Capital Ltd

High LME & lean cost structure to drive growth

Quick Pointers:

* Average Q2 alumina NSR was USD380/t, expected to be ~USD320-340/t in H2FY26.

* Mgmt. guided FY26 alumina production/ sales volumes at 2.2mt/ 1.28mt respectively

National Aluminium (NACL) delivered a strong operating performance in Q2FY26, driven by higher alumina inventory liquidation, improved metal realization and lower power & fuel costs. Alumina volumes rose 39% YoY to 396kt, while metal volumes declined 7% YoY to 112kt on weak domestic demand amid monsoon quarter. Alumina NSR eased 4% QoQ to USD404/t, whereas metal average realization improved 5% QoQ to USD 2,938/t. Cost tailwinds were visible with lower employee and P&F costs; aided by superannuation-led employee count reduction and higher captive coal. Mgmt. reiterated commissioning of 1mtpa alumina refinery and Pottangi bauxite mine by Jun’26, driving incremental alumina volumes from FY27.

Captive coal mines are ramping up well and are expected to meet up ~57% of coal requirement. Over the years NACL has improved its cost structure by adding captive coal mines and driving structural cost reduction measures. However, volume growth is missing in the near term due to its weak execution and NACL remains pure play on alumina/metal prices. We raise FY27/28E EBITDA by 4% each assuming higher LME prices of USD2,742/2,666 respectively. Maintain ‘Buy’ with revised TP of Rs281 (from Rs280, assigning same 5x EV/EBITDA multiple). At CMP, the stock is trading at 4.4x/3.7x EV of FY27/28E EBITDA.

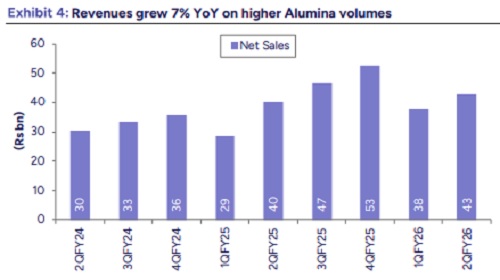

Revenue growth aided by higher alumina volumes: Revenue grew 7% YoY to Rs43bn (13% QoQ; PLe Rs41.9bn) aided by higher alumina sales volumes. Metal volume declined ~7% YoY to 112kt (due to weak demand in monsoon quarter) while alumina sales volume grew 39% YoY to 396kt on low affected base and liquidation of inventories. Alumina export volumes were up 33% YoY to 365kt while domestic volume were up 3x YoY to 31kt. Average realization for metal increased 5% QoQ to USD2,938/t (premiums to average LME declined to 12.1% from 13.9% QoQ). Average alumina NSR declined 4% QoQ to USD404/t. Q2FY26 average LME Ally/Alumina prices were up 7%/4% QoQ.

Strong EBITDA led by lower operating costs: NACL’s EBITDA grew 24% YoY to Rs19.3bn (29% QoQ; PLe Rs16.2bn) on higher alumina volumes and lower operating costs. RM costs declined 9% YoY, Power & fuel costs declined 10% YoY while other mfg expenses increased 16% YoY. Employee costs declined 8% YoY. Metal CoP works out at ~USD1,574/t for this quarter; (down -7% YoY & QoQ). Reported PAT grew 35% YoY to Rs14.33bn (+35% QoQ, PLe Rs11.4bn) aided by higher other income.

Segmental information: Chemicals segment (alumina) revenue grew 8% YoY to Rs18.34bn (13% QoQ, PLe R20.3bn) while aluminium segment revenue grew 6% YoY to Rs28.8bn (6% QoQ; PLe Rs29.9bn). Segmental EBIT margin for alumina was 34% (up 3pp QoQ) while segmental EBIT margin for metal increased 8pp QoQ to 41.3%.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271