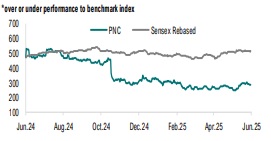

Buy PNC Infratech Ltd For Target Rs. 386 By Geojit Financial Services Ltd

Robust order book to drive growth...

PNC Infratech Ltd. (PNC) is an infrastructure construction, development and management company with the expertise in execution of projects including highways, bridges, flyovers, airport runways, industrial areas, and transmission lines.

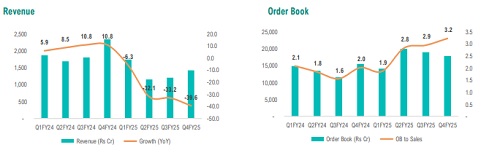

• The order book remains robust at Rs 17,792cr, which is 3.2x FY25 revenue, providing strong visibility for the coming years.

• Given the removal of the NHAI ban, the company is now eligible to bid for NHAI, & MoRTH projects and the management is expected to add Rs15,000cr of order inflows in FY26.

• In Q4FY25 PNC’s revenue declined by 39.6% YoY (in-line with our estimate) due to slow progress in execution on account of delays in getting appointed dates.

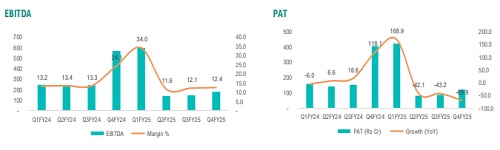

• Consequently, EBITDA margin during the quarter declined by 70 bps YoY to 12.4%. However, the management expects the revenue to grow by 20% YoY with an EBITDA margin of 13%.

• PNC is also focusing on expanding its order book to the railway and water segments. Currently, the water & canal segment constitutes 17% of the order book.

Outlook & Valuation

PNC has successfully completed the monetization of 10 HAM projects for an equity consideration of Rs.1,828cr (1.33x of investment). We expect this disinvestment and objective to diversify to other infra segments will augur well for the growth prospects. Ample opportunities in both road and non-road projects (Rs.90,000cr) with a strong balance sheet will aid in rerating. We therefore maintain a BUY rating with a target price of Rs 386, based on a P/E of 14x FY27 EPS and HAM assets at 0.5x P/B.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH20000034