Buy Kirloskar Pneumatic Company Ltd For Target Rs.1,620 by Prabhudas Liladhar Capital Ltd

Non-gas growth in sight despite macro challenges

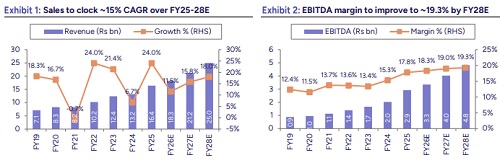

We interacted with the management of Kirloskar Pneumatic Company (KKPC) and discussed the prevailing macro environment, financial outlook, and progress across new product platforms. The management highlighted that both public and private capex remains subdued, resulting in delays in order finalizations and dispatches. Despite this, the company is confident of delivering double-digit revenue growth with stable margins in FY26, supported by resilient consumption-led demand. The Tezcatlipoca platform continues to scale well, with 115 units sold to date, and is expected to capture 75-80% market share, while strong momentum in Tyche positions the company to achieve ~200 unit sales in FY26. KKPC’s entry into the Rs50bn commercial refrigeration market through Zephyros, is expected to become a meaningful growth driver, potentially contributing peak annual revenue of ~Rs10bn starting FY27. Meanwhile, Gas Compression continues to face headwinds due to the absence of large project awards and muted orders. The stock is trading at PE of 23.5x/19.5x on FY27/28E earnings. We maintain our ‘BUY’ rating valuing the stock at PE of 33x Sep’27E (same as earlier) arriving at TP of Rs1,620 (same as earlier).

Project executions and order finalizations remain key monitorables in the short term. Despite the macro challenges, we believe KKPC is well placed for healthy long-term growth driven by 1) product launches in Air Compression (Tezcatlipoca, ARiA) to capture centrifugal and low-end screw compressor markets that are import-dominated; 2) new products – Calana and Jarilo – launched to address opportunities in CNG daughter stations and CBG plants, respectively; 3) launch of Tyche and Khione, and acquisition of S&C India to enhance penetration in commercial and industrial refrigeration; 4) focus on building in-house IP and backward integration capabilities; and 5) strong cash flows and balance sheet.

Key takeaways:

* Sector & demand environment

* The investment climate remains muted, with private sector capex still subdued and government-led project execution progressing slowly, except in defense.

* On-ground clearance delays are expected to continue for another 6 months, affecting order finalization cycles.

* Consumption-driven demand remains the primary growth lever, and is expected to sustain business momentum in the near term even as project-driven orders stay weak.

* Guidance & outlook

* The company expects Q3FY26 revenue of ~Rs5.0bn, with H2FY26 revenue exceeding Rs10.0bn, implying double-digit growth for the year.

* Several large customer packages have been completed and are scheduled for dispatch in the coming months, supporting the revenue trajectory.

* Margins are expected to remain stable through FY26 at ~18%, despite the softer project environment.

* Due to a slowdown in project finalizations, the company anticipates Rs2.0-4.0bn lower order intake in FY26.

* Weak project inflows may challenge the ability to deliver 20%+ growth in FY27, despite the strength in consumption-led segments.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)