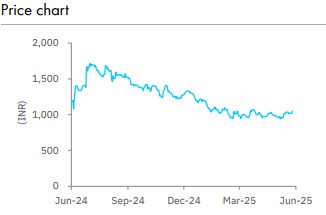

Accumulate Amara Raja Energy & Mobility Ltd for Target Rs. 1,108 by Elara Capitals

Muted quarter, near-term headwinds to persist

Amara Raja Energy & Mobility (AMRJ IN) Q4 standalone revenue grew by 6% YoY and down 6% QoQ, led by robust aftermarket performance in PV and 2W partly offset by weakness in the industrial segment. While the lead acid business grew 4% YoY, the industrial segment witnessed a muted quarter, led by weakness in the telecom segment, which contracted 15% YoY. On low base, the new energy business surged 35% YoY, although annual growth remains flat due to loss of share in key accounts. Absolute EBITDA contracted 16.1% YoY and 17.7% QoQ to INR 3.4bn, with a margin at 11.5%, down 300bp YoY and 160bp QoQ in Q4FY25, due to higher raw material and power cost. While lead acid business in the auto segment remains steady, the industrial segment, led by telecom (which is under pressure), and ramp-up of the Li-ion cell business (also pricing of Li-ion cells globally -- our recent visit to China indicates the possibility of further downside to Li-ion cell prices) will be key monitorable. We reiterate Accumulate with a reduced TP of INR 1,108 based on 14x June 2027E consolidated P/E.

Margin hit by higher Antimony and power cost: Margin in Q4 was adversely affected by elevated Antimony prices and higher power cost, which together compressed margin by 1.5- 2.0%. Additionally, warranty-related provisions further weighed on profitability. To offset these pressures, the company implemented a 2% price increase in April. While elevated Antimony and power cost are expected to continue for the next two quarters, the upcoming commissioning of the new tubular battery and recycling plants is likely to aid in margin recovery. Management reaffirmed its margin target of 14%, supported by the commissioning of new plants and improved operational throughput. While margin recovery is set to be gradual, cost tailwinds from the recycling and tubular battery facilities, along with recent price increases, are likely to aid in stabilizing and rebuilding profitability in FY26.

New project commercialization to provide relief from margin headwinds: Key capacity expansion initiatives, such as the tubular battery facility slated to commence operations in June 2025, and the lead recycling plant, which was commercialized in Q4, are expected to drive cost efficiency and margin enhancement in FY26. These strategic projects are considered critical enablers of the company’s 14% margin target, as they reduce raw material dependency and enhance production throughput.

Reiterate Accumulate with a reduced TP of INR 1,108: AMRJ’s lead acid battery business continues to outperform Exide’s revenue growth (AMRJ revenue growth at 6.0% vs Exide’s 3.7%). Double-digit replacement growth is a positive, in our view, and remains an insulation against cyclicality of OEM and the industrial business. We monitor further order wins in Liion cell manufacturing, especially for the PV OEM segment, which would drive valuation in the near term, even as profitability of Li-ion cell will remain cause for concern initially. We reiterate Accumulate with a reduced TP of INR 1,108 from INR 1,142 as we roll forward to June 2027E. Our new TP is based on 14x (unchanged) June 2027E consolidated P/E (INR 232 ascribed to the Li-ion battery business). We tweak FY26-27 estimates by 3-4% and introduce FY28E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933