Neutral Amara Raja Ltd for the Target Rs. 1,075 by Motilal Oswal Financial Services Ltd

Higher RM and power costs hurt margins

Costs likely to remain elevated for next couple of quarters

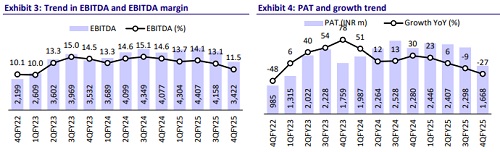

* Amara Raja’s (ARENM) 4QFY25 results missed our estimates as EBITDA and PAT were hit by higher metal costs and a power cost adjustment from the Andhra Pradesh government for FY24. Costs are likely to remain high at least for the next couple of quarters, as per management.

* We cut our FY26/FY27 EPS estimates by 7%/2% to factor in provisions related to higher power and other operational costs. While the market is optimistic about ARENM’s li-ion initiative, we are cautious about its potential returns. We believe the stock, trading at around 20.5xFY26E/17.3x FY27E EPS, appears fairly valued. Therefore, we maintain a Neutral rating with a TP of INR1,075, based on 18x FY27E EPS

Margins impacted by higher operational costs

* ARENM posted a weak 4Q performance, with PAT at INR1.7b down 27% YoY and below our estimate of INR2.1b.

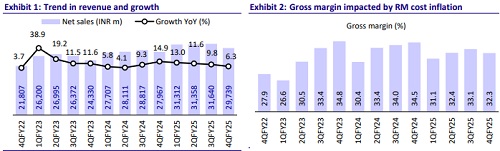

* Revenue grew 6% YoY to INR29.7b, below our estimate of INR31.6b.

* In the domestic 4W segment, aftermarket grew 9% and OEM grew 15%. However, exports fell 10% YoY due to weak demand in the APAC region.

* 2W volumes rose 13% YoY, led by similar growth in both OEM and aftermarket segments.

* Home invertor segment also posted healthy growth of 17% YoY.

* Within industrials, the UPS segment saw healthy growth in 4Q. However, telecom saw 15% YoY decline due to a shift in preference toward lithiumion.

* Margin declined 310bp YoY to 11.5%, below our estimate of 12.7%.

* 4Q margins were impacted by: 1) an increase in prices of non-lead alloys like antimony; and 2) persistent challenges in power costs. Moreover, ARENM faced another headwind from a delay in the settlement with regulators on power generated from its own solar plants. Trading revenue was higher in 4Q, as ARENM stocked up to have enough supply for the upcoming summer season.

? For FY25, revenue grew 10% YoY to INR124b.

* Margin declined 130bp YoY due to rising input costs and higher power costs.

* Overall, FY25 PAT declined 3% YoY to INR8.8b.

* The board has recommended a dividend of INR10.5 per share, which translates into a payout of 20%.

* The standalone entity delivered FCF of INR6.3b in FY25 post capex of INR7.4b.

Highlights from the management commentary

* Auto demand outlook: Based on its discussion with OEMs, ARENM expects flat demand for 4W OEMs in 1QFY26 and a pickup in 2QFY26. Even in 2W segment, volumes are actually down so far in 1Q, but ARENM hopes for a pickup in 2Q.

* Management has indicated that the issue of higher power costs and higher nonlead alloy costs is likely to persist for the next couple of quarters. It would look to offset this by: 1) price hikes taken in Apr’25, 2) the commencement of tubular plant production in 2QFY26, and 3) the full commencement of a lead recycling plant in 3QFY26.

* In the new energy business, its customer qualification plant is set to SOP in 2Q3QFY26. It expects its first gigawatt factory to come on-stream in 1HFY27. This will be the first phase of the 4GWh battery plant, which would eventually reach 16 GWh by 2030, based on current plans.

* Management said that in FY26, it plans to invest almost the same amount as in FY25 (INR12b). However, the bulk of this investment would go to the new energy business for the customer qualification plant, the first phase of the giga factory and R&D facility in Hyderabad.

Valuation and view

* ARENM’s venture into the lithium-ion business is strategically sound given the opportunities in the segment and risks facing its core business. However, there are notable challenges: 1) market opportunities are limited by existing OEM partnerships; 2) low-margin nature of lithium-ion business is likely to dilute returns; and 3) long-term viability of technology remains uncertain despite the large capital investment.

* While the market is optimistic about ARENM’s li-ion initiative, we are cautious about its potential returns. We believe the stock, trading at around 20.5x FY26E/17.3x FY27E EPS, appears fairly valued. Therefore, we maintain a Neutral rating with a TP of INR1,075, based on 18x FY27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412