Buy Atul Ltd for the Target Rs. 7,520 by Motilal Oswal Financial Services Ltd

Performance segment continues to drive growth

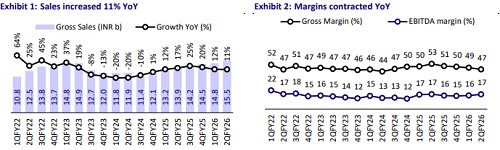

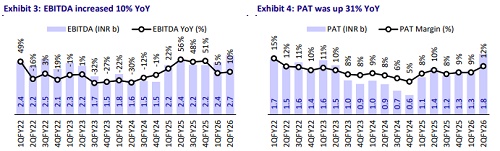

* Atul (ATLP) reported in-line revenue of INR15.5b (+11% YoY) in 2QFY26. Revenue from the Performance & Other Chemicals segment increased 12% YoY, while the Life Science Chemical segment’s revenue rose 8% YoY. EBITDA grew 10% YoY to INR2.7b and PAT increased 31% YoY to INR1.8b.

* We broadly retain our estimates for FY26/FY27/FY28. We estimate a CAGR of 12%/14%/17% in revenue/EBITDA/PAT during FY25-28E. The stock is trading at ~23.8x FY27E EPS of INR250.5 and ~14.3x FY27E EV/EBITDA. We value the stock at 30x FY27E EPS to arrive at our TP of INR7,520. Reiterate BUY.

EBITDA miss; PAT in line due to higher-than-expected other income

* ATLP’s revenue was INR15.51b (+11% YoY). Life Science Chemicals’ revenue stood at INR4.4b (+8% YoY), while Performance Chemicals’ revenue was INR11.45b (+12% YoY) during the quarter.

* Gross margin stood at 46.6% (vs. 53.1% in 2QFY25) and EBITDA margin contracted 20bp YoY to 17.2%. EBIT margin contracted for Performance and Other Chemicals but expanded for Life Science Chemicals on a YoY basis. Life Science Chemicals EBIT margin stood at 22.9% (+240bp YoY), while EBIT stood at INR1b. Performance Chemicals' EBIT margin was 9.1% (- 60bp YoY) and EBIT came in at INR1b.

* The company’s consolidated EBITDA grew 10% YoY to INR2.7b (est. of INR2.9b) and adj. PAT grew ~31% YoY to INR1.8b (est. in line).

* In 1HFY26, consolidated revenue/EBITDA/adj. PAT grew ~12%/8%/25% to INR30.3b/INR5b/INR3.1b.

* The Life Science segment recorded revenue/EBIT growth of ~7%/10% YoY to INR8.9b/INR1.7b and EBIT margin expansion of 50bp YoY to 19% in 1HFY26. The Performance segment recorded revenue/EBIT growth of ~13%/11% YoY to INR22.1b/INR2b and EBIT margin contraction of 20bp YoY in 1H.

Valuation and view

* The company is undertaking various projects and initiatives aimed at improving plant efficiencies, expanding its capacities for key products, debottlenecking its existing capacities, capturing a higher market share, and expanding its international presence.

* The stock is trading at ~23.8x FY27E EPS of INR250.5 and ~14.3x FY27E EV/EBITDA. We largely maintain our earnings and reiterate our BUY rating on the stock. We value the stock at ~30x FY27E EPS to arrive at our TP of INR7,520. The upside risk could be a faster-than-expected ramp-up of new projects and products. Downside risks include weaker-than-expected revenue growth and margin compression amid teething issues in new projects.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)