Buy State Bank of India Ltd for the Target Rs. 1,075 by Motilal Oswal Financial Services Ltd

Steady quarter; NII growth surprises positively

Margins expand 7bp QoQ to 2.97%

* State Bank of India (SBIN) reported 2QFY26 PAT of INR201.6b (10% YoY growth, 21% beat), supported by an exceptional gain of INR45.9b from the divestment of 13.18% of its shareholding in Yes Bank. Adj. PAT stood at INR167b (in-line; down 9% YoY/13% QoQ).

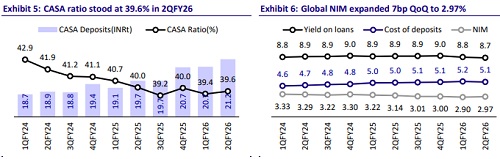

* NII grew 3.3% YoY/4.7% QoQ to INR429.8b (6% beat). NIM stood at 2.97% (7bp QoQ rise), with domestic NIMs improving 7bp QoQ to 3.09%.

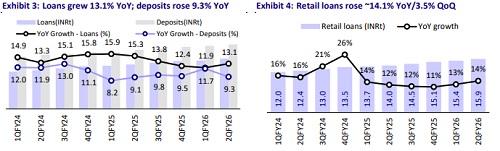

* Loan book grew 13% YoY/4% QoQ, while deposits grew 9.3% YoY/2.2% QoQ. CASA ratio stood at 39.6%.

* Slippages moderated to INR49.98b (vs INR84b in 1QFY26). GNPA/NNPA ratio improved 10bp/5bp QoQ to 1.73%/0.42%. PCR increased to 75.8%.

* We raise our adj. earnings by 5.8%/3.1% for FY26/27E and estimate FY27E RoA/RoE at 1.1%/15.5%. Reiterate BUY with a TP of INR1,075 (1.4x FY27E ABV + INR242 for subs).

Advances growth healthy; asset quality improves further

* SBIN reported 2QFY26 PAT of INR201.6b (10% YoY growth, 21% beat), supported by stake sale gains in Yes Bank and robust NII growth. Adj. PAT stood at INR167.7b (in-line; down 9% YoY/13% QoQ).

* NII grew 3.3% YoY/4.7% QoQ to INR429.8b (6% beat). NIM stood at 2.97% (7bp QoQ gain). SBIN expects FY26 domestic NIMs to be maintained at >3%.

* Other income stood flat YoY/declined 11.6% QoQ to INR153b (in-line) as treasury gains (excluding stake sale) stood at INR28.8b vs INR63.3b in 1QFY26. Core fee income, however, grew at a robust 25.4% YoY.

* Opex grew 12.3% YoY/11.2% QoQ to INR309.9b (6% higher than MOFSLe), led by GST, software, and training expenses. PPoP declined 7% YoY/declined 11% QoQ to INR273b (in-line).

* Advances grew healthy at 13% YoY/4% QoQ. Of this, retail grew 14% YoY/3.5% QoQ, agri grew 5.7% QoQ, and SME grew 19% YoY/2.7% QoQ. Corporate growth was 7% YoY/3% QoQ. Xpress credit grew 1.6% QoQ; the bank expects the segment to improve going forward.

* Provisions increased 20% YoY (20% higher than our estimate) to INR54b. Deposits grew 9.3% YoY/2.2% QoQ. CASA ratio stood at 39.6%. CD ratio increased to 78% vs 76.7% in 1QFY26.

* Slippages moderated to INR49.98b (slippage ratio at 0.45%). GNPA/NNPA ratio improved 10bp/5bp QoQ to 1.73%/0.42%, while PCR ratio increased to 75.8%. Credit cost moderated to 0.39%, while SMA book stood at 9bp of loans (12bp in 1QFY26).

* Subsidiaries: SBICARD clocked a PAT of INR4.5b (rising 10% YoY/declining 20% QoQ). SBILIFE’s PAT declined 6.4% YoY (down 17% QoQ) to INR4.95b. PAT of the AMC business grew 7% YoY/declined 12% QoQ to INR7.4b.

Highlights from the management commentary

* SBIN reiterates its domestic NIM guidance of over 3%. RoA would be 1.04% excluding stake sale gains.

* The bank has guided for loan growth of ~12-14%, led by growth across its business segments.

* The extraordinary gain from the Yes Bank stake sale was about INR45b gross of tax and INR33.86b net of tax.

* GST on expenses stood at INR10.8b in 2QFY26 vs INR6.62b in 2QFY25.

* The bank incurred training expenses of ~INR5.5b, as many of the new recruits are individuals preparing for examinations. The bank conducted extensive training programs to prepare them for various assignments.

Valuation and view

SBIN reported a steady quarter, led by robust NII, resilient margins, and one-off gains from the Yes Bank stake sale. NIM expanded 7bp QoQ to 2.97%, and management expects a further recovery in 3Q and 4Q, supported by improved liquidity from CRR cuts. Opex was higher due to GST and training expenses, while robust revenue growth resulted in in-line PPoP. Credit growth was healthy at 13% YoY, while a robust credit pipeline is expected to support a healthy outlook in FY26. Management guided FY26E loan growth at 12-14%. Asset quality also saw an improvement, with slippages improving and credit cost remaining benign at 39bp. We raise our adj. earnings by 5.8%/3.1% for FY26/27E and estimate FY27E RoA/RoE at 1.1%/15.5%. Reiterate BUY with a TP of INR1,075 (1.4x FY27E ABV + INR242 for subs).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412