Buy Reliance Industries Ltd for the Target Rs. 1,700 by Motilal Oswal Financial Services Ltd

Operationally in-line 2Q; FCF generation picks up significantly in 1H

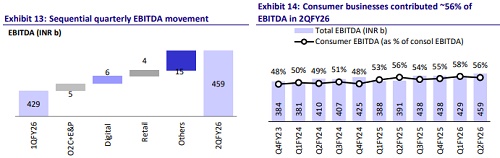

* RIL posted an operationally in-line 2Q, with consolidated EBITDA rising 5% QoQ to INR459b (+10% YoY), driven by a strong recovery in Reliance Retail (RR).

* For RR, growth rebounded in 2Q, with 18-23% YoY growth across key categories and 17% YoY growth in EBITDA (2% ahead).

* RJio EBITDA was up ~3.5% QoQ (~1% ahead), driven by ~8.3m net adds and rising customer engagement on 5G/FWA.

* Consol. O2C EBITDA grew 3% QoQ (up 21% YoY, in line), aided by improvement in key product cracks. E&P EBITDA was flat QoQ (-5% YoY).

* RIL’s other income declined 8% YoY (-28% QoQ) to INR45b, while D&A/interest costs rose 12%/13% YoY.

* Attributed PAT grew 10% YoY to INR182b (+1% QoQ) and was 10% below our estimate, largely due to lower other income.

* Reported capex for the quarter increased sharply to INR400b (vs. INR299b QoQ, +18% YoY), while cash capex declined ~15% YoY to INR605b in 1HFY26.

* RIL's reported net debt increased ~INR10b QoQ to INR1.19t (vs. INR1.16t YoY). However, calculated debt (including spectrum liabilities and creditors for capex etc.) inched up by ~INR130b in 1HFY26 to INR2.9t, on our estimates.

* Consol FCF for 1HFY26 improved to INR309b (vs. INR92b YoY), driven by ~14% YoY increase in EBITDA, moderation in cash capex and boost from Asian Paints stake sale. Even after excluding Asian Paints stake sale, RIL's consol FCF improved meaningfully to ~INR220b.

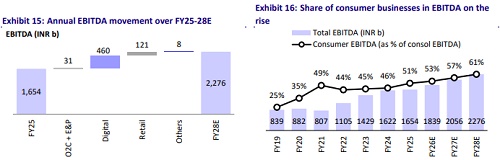

* Our FY26-28E EBITDA is broadly unchanged; however, we cut our FY26-28E attributable PAT by 3-4% due to lower other income, higher interest costs and rising minority interest. We build in a CAGR of ~10-11% in RIL’s consolidated EBITDA and PAT over FY25-28.

* We reiterate our BUY rating with a revised TP of INR1,700 (earlier INR1,685).

Reliance Retail – Broad-based growth recovery; QC up 42% QoQ

* After a soft revenue growth of 11% in 1Q, RR’s net revenue growth saw an uptick to 19% YoY (5% beat, albeit on a low base). The growth was broadbased with 18-23% YoY growth across key categories, driven by the boost from early festive and GST rationalization.

* RR added 229 net stores (412 additions and 183 closures) during 2Q. Net retail area grew by a modest 0.2m QoQ to 77.8m sqft (-2% YoY).

* Blended operational EBITDA grew ~17% YoY to INR66b (2% ahead) as margins declined ~15bp YoY to 8.4% (25bp miss).

* RR’s quick hyperlocal deliveries on JioMart delivered strong growth of 42% QoQ and 200%+ YoY in average daily orders.

* Reliance Consumer Brands delivered revenue of INR54b (2x YoY), with Campa sustaining double-digit market share in key markets.

* With a likely end of store rationalizations, rising traction in quick commerce, and a boost from the upcoming festive season and GST rationalization, we believe RR’s growth could be sustained at mid-teens over the medium term.

* We raise our FY26-28E revenue by 2-3% and EBITDA by a modest ~1%. We expect a CAGR of ~15% in RR’s revenue/EBITDA over FY25-28E.

RJio – Largely in line; net debt declines as 1H FCF improves to INR63b

* RJio’s standalone revenue grew ~3% QoQ (+12% YoY), driven by 1% QoQ ARPU uptick (one extra day QoQ) and ~8.3m subscriber net adds (FWA ramp-up).

* EBITDA grew ~3.5% QoQ (+15% YoY) to INR173b (vs. our estimate of INR171.5), driven by lower network opex (flat QoQ, 2% below).

* EBITDA margin expanded ~20bp QoQ to 54.2% (~15bp beat), with incremental EBITDA margin at ~60% (slightly higher vs. our estimate of ~56%).

* JPL’s non-mobility revenue and EBITDA continued to see acceleration, with 8% and 6% QoQ growth, respectively, benefitting from a rising FWA base and traction in B2B.

* 1HFY26 cash capex (incl. payment of creditors for capex and principal component of spectrum repayments) was largely flat YoY at INR224b (vs. INR221b YoY), while gross block additions (a proxy for committed capex) in 1HFY26 inched up to INR251b (vs. ~INR204b YoY).

* 1HFY26 FCF (post interest, leases and spectrum repayments) improved to INR63b (vs. IN6b/INR39b in 1HFY25/FY25), driven by 17% YoY higher EBITDA.

* Effective net debt (including spectrum debt and creditors for capex) declined by INR78b in 1HFY26 to INR1.79t.

* We raise our FY26-28 revenue and EBITDA estimates by ~1% each, driven by higher net adds in fixed broadband and the corresponding boost to blended ARPU. We continue to build in next round of tariff hike (15% or INR50/month on the base pack) from Dec’25. Any delay in tariff hike would pose downside risks.

* We expect FY25-28E revenue/EBITDA/PAT CAGR of ~16%/19%/24% for RJio, driven by tariff hike flow-through in wireless and acceleration in FWA offerings.

Standalone: In-line result; higher volumes, cracks drive QoQ recovery

* Revenue stood at INR1,263b (-3% YoY). EBITDA was in line at INR144b (est. INR149b; +7% YoY). Reported PAT was also in line with our estimate at INR91b (up 18% YoY).

* As of 30th Sep’25, RIL’s standalone CWIP stood at INR985.2b (vs. INR763.2b as of 31st Mar’25). Net debt stood at INR605b (vs. INR619b as of 31st Mar’25). In 1HFY26, the company generated CFO of INR453.2b (up 7% YoY).

* O2C: 2QFY26 EBITDA grew 17% YoY to INR98.6b, reflecting a sharp rebound in transportation fuel cracks (up 22-37%) and improved polymer margins. Production meant for sale increased 2.3% YoY, supported by higher throughput across both primary and secondary units. The Jio-bp network added 236 new outlets YoY, resulting in robust volume growth of 34% in HSD and 32% in MS. The benefit was partly offset by weaker polyester chain deltas.

* E&P: 2Q revenue fell 2.6% YoY, mainly due to the natural decline in production from the KGD6 block (-8.4% YoY). Additionally, lower realizations for CBM gas and condensate weighed on revenues. This impact was partially offset by higher gas prices from KGD6 and increased CBM gas volumes. The average realized price for KGD6/CBM gas stood at USD9.97/9.53mmbtu in 2QFY26 (up 4% YoY/down 16% YoY). EBITDA declined 5% YoY to INR49.9b, due to lower revenue and higher operating costs arising from periodic maintenance activities.

* Near-term dynamics:

* Downstream chemical margins are expected to remain constrained due to elevated supply levels and continued volatility in feedstock prices.

* Refinery rationalization and supply disruptions are likely to support export demand. Further, domestic demand is anticipated to strengthen during the festive season in 3QFY26.

* The company will maintain its focus on the domestic market and continue to provide customer-centric, innovative solutions. Jio-bp aims to expand its network and enhance its portfolio of new mobility solution offerings.

* Significant refining capacity closures anticipated in Europe and North America during CY25/26, resulting in limited net capacity additions, are expected to support refining margins.

Valuation and view

* Our FY26-28E EBITDA is broadly unchanged, though we cut our FY26-28E attributable PAT by 3-4% due to lower other income, higher interest cost and rising minority interest.

* We expect RJio to remain the biggest growth driver, with 19% EBITDA CAGR over FY25-28E, driven by one more tariff hike (~15% from Dec’25), market share gains in wireless, and continued ramp-up of the Homes and Enterprise offerings.

* With store rationalizations largely complete and the scale-up of quick hyper-local deliveries on JioMart and AJio, we expect RR to deliver ~15% revenue/EBITDA CAGR over FY25-28E.

* After a subdued FY25, we expect earnings to recover in the O2C segment, driven by improvement in refining margins. However, our FY28E consolidated EBITDA for O2C and E&P remains ~4% lower than FY24 levels.

* Overall, we build in a CAGR of ~10-11% in RIL’s consolidated EBITDA and PAT over FY25-28.

* We model an annual consolidated capex of INR1.3t for RIL over FY25-28E, as the moderation in RJio capex is likely to be offset by higher capex in New Energy and Datacenter forays. However, we believe the peak of capex is behind, which should lead to healthy FCF generation (~INR1.1t over FY25-28E) and a corresponding decline in consol. net debt.

* For Reliance Retail, we ascribe a blended EV/EBITDA multiple of 30x (32x for core retail and ~7x for connectivity) to arrive at an EV of ~INR10.4t for RRVL and an attributable value of INR625/share (earlier INR600/share) for RIL’s stake in RRVL. Sustained mid- to high-teens growth in retail revenue remains key to RIL’s rerating.

* We value RJio on DCF implied ~13x Dec’27 EV/EBITDA to arrive at our enterprise valuation of INR12.4t (USD141b) and assign ~USD9b valuation to other nonmobility offerings under JPL to arrive at INR13.2t (or ~USD150b) enterprise valuation. Factoring in net debt and ~33.5% minority stake, the attributable equity value for RIL comes to INR585/share (vs. INR575 earlier).

* Using the SoTP method, we value the O2C/E&P segments at 7.5x/5.0x Dec’27E EV/EBITDA to arrive at an enterprise value of INR5.5t (or ~INR406/sh) for the standalone business. We ascribe an equity valuation of INR585/sh and INR625/sh to RIL’s stake in JPL and RRVL, respectively. We assign INR110/sh (~INR1.5t equity value) to the New Energy business and INR26/sh (~INR350b) to RIL’s stake in JioStar. We reiterate our BUY rating with a revised TP of INR1,700 (earlier INR1,685).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412