Buy Siemens Energy India Ltd for the Target Rs. 3,800 by Motilal Oswal Financial Services Ltd

Strong FY25 performance

Siemens Energy India (ENRIN) reported a strong set of financials for full year FY25, with an outperformance in revenue and EBITDA. Lower-than-expected other income to some extent offset the strong performance in revenue, resulting in almost in-line PAT performance. 4QFY25 performance was impacted by lower-than-expected margin and other income. Order inflows for the full year stood strong at INR131b vs. our estimate of INR101b, providing strong visibility for both power transmission and power generation segments. We broadly maintain our estimates and TP of INR3,800, based on 60x two-year forward earnings. We maintain our positive bias for ENRIN as we expect the company to benefit from a strong opportunity in power transmission segment, margin improvement, and ongoing capex going forward. We will revisit our estimates after the analyst meet of the company.

Revenue beat; miss on PAT due to lower other income

ENRIN delivered a strong revenue and EBITDA beat in 4QFY25, though lowerthan-expected other income resulted in a PAT miss. Revenue stood at INR26b (+27% YoY), driven by strong growth in the power transmission segment and a healthy order backlog. Gross margin expanded 100bp YoY to 35.6%. EBITDA came in at INR4.8b, up 25% YoY/41% QoQ, with margins at 18.1%. PAT grew 31% YoY to INR3.6b, with margins expanding 40bp YoY to 13.6%. Order inflow during the quarter was broadly flat YoY at INR23.5b, while FY25 order inflow stood at INR131b. For FY25, revenue/EBITDA/PAT stood at INR78b/INR15b/ INR11b, while EBITDA margin was 19.3% (margin of 20% after adjusting the provision for stamp duty and related charges of INR546m). For FY25, OCF/FCF stood at INR36.7b/INR34.5b. The company declared a dividend of INR4 per share.

Segmental performance

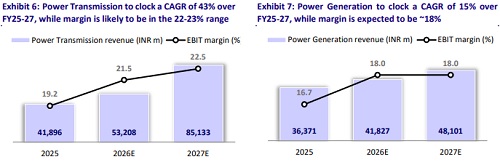

The power transmission segment’s 4Q revenue increased 48% YoY to INR14b, while EBIT stood at INR2.5b, leading to 200bp YoY margin expansion to 18.1%. For FY25, the power transmission segment’s revenue/EBIT stood at INR42b/ INR8b, while EBIT margin was 19.2%. The power generation segment’s revenue rose 11% YoY to INR13b and EBIT declined 8% YoY to INR2b, leading to 320bp YoY contraction in EBIT margin to 15.6%. For FY25, the power generation segment’s revenue/EBIT stood at INR36b/INR6b, and EBIT margin was 16.7%.

Working capital improving, capex on track

Net working capital days improved to 5 vs. our estimate of 30, driven by better receivable and liability positions than anticipated. Capex incurred for FY25 was INR2.2b, slightly below our estimate of INR2.5b; however, the ongoing capex of INR7.4b (INR4.6b for power transformers in Kalwa and INR2.8b for capacity expansion of high-voltage switchgear products) will enable the company to meet the growing demand for power transmission equipment, both in India and global markets.

Outlook remains strong across segments

We expect ENRIN’s power transmission segment to grow significantly faster, supported by planned T&D investments of INR3t over FY25-30, largely concentrated in 400kV and 765kV HV lines that form the backbone of inter-state transmission. Siemens, being one of the few players with capabilities of up to 765kV, is well positioned to benefit from this capex cycle. State-level ISTS strengthening initiatives, with an estimated investment opportunity of INR120b, add further visibility. ENRIN also aims to deepen its presence in HVDC, with a focus on VSC-based systems. Meanwhile, the power generation segment, which is centered on industrial gas turbines, is expected to track trends in private-sector capex.

Financial outlook

We broadly maintain our FY26/FY27 estimates. We expect revenue/EBITDA/PAT CAGR of 30%/39%/41% over FY25-27E, led by strong growth across power transmission (43% CAGR) and power generation (15% CAGR). We expect EBITDA margins of 21.1%/21.8% for FY26/FY27. We will revisit our estimates after the analyst meet of the company.

Valuation and view

ENRIN is currently trading at 75.4x/51.3x P/E on FY26E/27E EPS. We broadly maintain our estimates and TP of INR3,800, based on 60x two year forward earnings.

Key risks and concerns

Key risks to our thesis can come from a slowdown in ordering and supply chain issues, thus impacting margin.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412