Buy JSW Infrastructure Ltd for the Target Rs. 370 by Motilal Oswal Financial Services Ltd

Ports and logistics expansion plans to fuel sustainable growth

* JSWINFRA’s focus on brownfield capacity augmentation, infrastructure modernization, and strategic acquisitions aligns with India’s port sector growth drivers (government plans to quadruple port capacity to 10,000MTPA by FY47 from ~2,700MTPA currently). Its ability to leverage group cargo while expanding third-party contributions positions (49% contribution in FY25) it as a leader in India’s logistics and port infrastructure space.

* JSWINFRA has reaffirmed that port capacity expansion remains a key priority, with a goal to achieve 400MTPA by FY30 from 177MTPA currently.

* Further, the company has an aggressive roadmap to build its logistics infrastructure network under JSW Ports Logistics with a capex of INR90b by FY30. This investment is expected to generate revenue of INR80b and EBITDA of INR20b.

* JSWINFRA’s planned INR55b capex for FY26 (INR40b for ports and INR15b for logistics), compared to INR24.4b in FY25, reflects strong confidence in future growth. This investment is expected to drive a minimum 10% growth in port volumes and a 50% increase in logistics revenue in FY26.

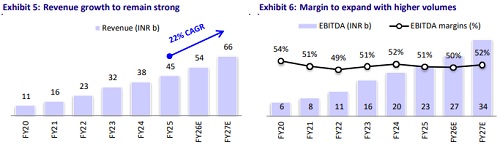

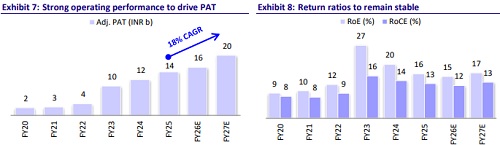

* Considering stable growth levers at its existing ports and terminals, a higher share of third-party customers, steady cargo volumes from JSW Group companies, and an expanding portfolio, we expect JSWINFRA to strengthen its market dominance, leading to a 13% volume CAGR over FY25-27E. This should drive a 22% CAGR in revenue and a 23% CAGR in EBITDA over the same period. We reiterate our BUY rating with a TP of INR370 (premised on 23x Sep’26E EV/EBITDA).

Strong growth potential in port capacity expansion

* JSWINFRA is strategically positioned to capitalize on India’s growing port infrastructure needs, with a goal to expand its port capacity to 400MTPA by FY30 from 177MTPA as of Mar’25. Recent expansions at JNPA, Tuticorin, Mangalore, and TNT ports have already increased its capacity from 170 MTPA in Dec’24 to 177MTPA in Mar’25, demonstrating execution capability.

* Significant progress in FY25 on projects like Tuticorin, JNPA, and Southwest Port Goa (capacity increased to 11MTPA, with 15MTPA pending approval) underscores JSWINFRA’s ability to deliver on its expansion roadmap. Upcoming projects, such as the JNPA Liquid Terminal (commissioning by JulAug’25) and Mangalore Container Terminal (completion by 2QFY27) further strengthen its growth trajectory.

* The Indian government’s Maritime India Vision 2030 and long-term goal to quadruple port capacity to 10,000MTPA by 2047 create a favorable environment. JSWINFRA, as a leading private player, is well-positioned to capture a significant share of this growth through brownfield expansions and new projects.

Robust logistics business expansion

* JSWINFRA’s INR90b capex plan by FY30 for JSW Ports Logistics aims to generate INR80b in revenue and INR20b in EBITDA, with a targeted 25% EBITDA margin.

* The planned INR1.7b investment in Navkar Corporation in FY26 aims to revitalize its operations and increase EBITDA to INR1b from INR410m in FY25. This focus on unlocking untapped potential strengthens JSWINFRA’s logistics portfolio.

* The allocation of INR6b in FY26 for rakes and Vertical Cargo Terminals (VCTs) will enhance logistics throughput and terminal efficiency. Additionally, exploring acquisition opportunities within the INR15b logistics capex budget signals proactive growth in this segment.

Strategic positioning and operational excellence

* The company’s focus on increasing third-party cargo (projected to stabilize at 45-55% of the mix, primarily from energy and steel sectors) and improving utilization levels at existing ports ensures a balanced revenue mix. The Dolvi steel plant’s expansion to 15MTPA by mid-2027 will further boost cargo demand, supporting volume growth.

* The 302km slurry pipeline (180km completed, commissioning by Mar’27) and expansions at Jaigarh and Dharamtar to support JSW Steel’s Dolvi plant demonstrate JSWINFRA’s alignment with group synergies while catering to third-party demand.

* Interim operations at JNPA (0.1MT handled in 4QFY25) and Tuticorin (0.9MT in 4QFY25) reflect operational agility, with full project completions set to further boost capacity and efficiency.

Valuation and view

* JSWINFRA presents a compelling investment opportunity with its ambitious port capacity expansion to 400 MTPA by FY30, a robust logistics growth strategy targeting INR80b in revenue, and disciplined financial execution with significant capex commitments. Supported by favorable government policies and strong operational momentum, the company is well-positioned to deliver sustained volume growth, diversified revenue streams, and attractive margins.

* We expect JSWINFRA to strengthen its market dominance, leading to a 13% volume CAGR over FY25-27E. This, along with a sharp rise in logistics revenues, is expected to drive a 22% CAGR in revenue and a 23% CAGR in EBITDA over the same period. We reiterate our BUY rating with a TP of INR370 (based on 23x FY27 EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)