Buy Mankind Pharma Ltd for the Target Rs. 2,800 by Motilal Oswal Financial Services Ltd

2Q in line; transition phase underway

DF revival and BSV scale-up to drive medium-term performance

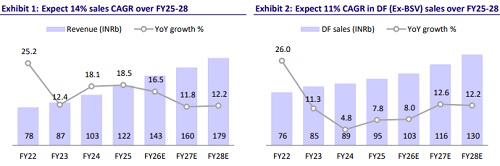

* Mankind Pharma (MANKIND) delivered a largely in-line financial performance for 2QFY26. EBITDA was slightly lower than estimates due to higher employee costs. MANKIND undertook a restructuring exercise, including talent upgrade and an increase in the sales force, driving higher opex for the quarter.

* MANKIND continued to deliver industry-beating growth in domestic formulation (DF) for certain therapies such as cardiac and diabetes. The company also recorded healthy growth in in-licensed inhaler products for the quarter.

* However, this was partially offset by lower medicine offtake in Tier II/Tier III cities, driven by GST-related factors.

* The OTC segment was also impacted by the GST transition during the quarter. Notably, key launches like Epic ThinX/Ovanews saw healthy traction in 2QFY26.

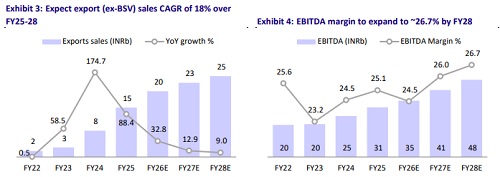

* With the consolidation of the BSV portfolio, export growth is expected to improve in 2HFY26.

* We largely maintain our estimates for FY26/FY27/FY28. We value MANKIND at 42x 12M forward earnings to arrive at a TP of INR2,800. The company is transforming its DF segment to be future-ready, aiming for sustained industry outperformance across therapeutic and consumer health segments. Additionally, it is in the process of consolidating BSV and taking steps to integrate the acquisition and build synergies. The financial leverage will further lead to a YoY decline in earnings for FY26. Subsequently, we expect MANKIND to deliver 31%/21% YoY growth in earnings for FY27/FY28. Reiterate BUY.

Higher opex drags profitability on a YoY basis

* Sales grew 20% YoY to INR36.9b for the quarter (vs est. INR37.6b).

* Domestic business (86% of sales) grew 14% YoY to INR31.8b for the quarter, driven by growth in the base business and the BSV consolidation. Prescription business (Rx) (92% of domestic sales) grew 16% YoY to INR29.6b. The consumer business (8% of domestic sales) declined 2.6% YoY to INR2.3b, primarily due to supply chain disruptions led by GST.

* Export (13% of sales) grew 82.6% YoY to INR5.1b, primarily due to the consolidation of BSV.

* Gross margin slightly contracted 30bp to 71.3%.

* EBITDA margin contracted 270bp YoY to 24.9% due to an increase in employee costs (+130bp YoY) and other expenses (+110bp YoY) as a % of revenue. EBITDA grew at a lower rate of 8% YoY to INR9.2b (vs our estimates of INR9.7b).

* PAT declined 22% YoY to INR5.0b (our est: INR5.0b).

* Revenue/EBITDA grew ~22%/12% YoY to ~INR72.7/17.7b, while PAT declined ~23% to INR9.4b in 1HFY26.

Highlights from the management commentary

* On an organic basis, MANKIND’s DF Rx segment grew 6.6% YoY in 2QFY26.

* Due to its strong presence in Tier-II/Tier-III cities and a higher share in Acute therapies, MANKIND witnessed a greater adverse impact of GST on YoY growth in the DF Rx segment.

* The OTC business was also impacted by supply chain disruptions and uneven monsoon.

* MANKIND expects a recovery in 2HFY26 across the Rx and OTC segments. The company has guided for the lower end of a 25-26% EBITDA margin in FY26.

* MANKIND has maintained its guidance of 18-20% YoY growth in BSV sales for FY26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412