Buy Syrma SGS Technology Ltd for the Target Rs. 960 by Motilal Oswal Financial Services Ltd

Strong performance across all fronts

Operating performance beats our estimates

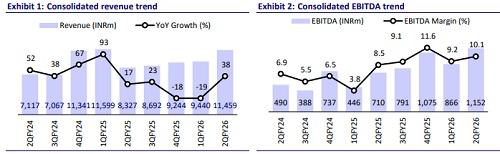

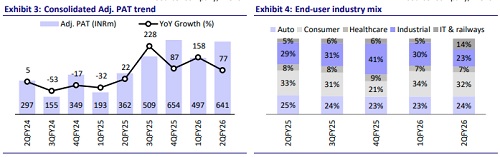

* Syrma SGS Technology (SYRMA) continued its strong operating performance, with EBITDA up ~62% YoY in 2QFY26. EBITDA margin expanded 150bp YoY due to a favorable business mix and better operating leverage. Revenue grew 38%, largely led by a strong jump in IT/Railways revenue (up 4x), followed by the Consumer/Auto businesses, which grew 35%/28% YoY.

* The order book continued to improve to INR58b as of 1HFY26 (up ~21% YoY), with margins witnessing an expansion. Moreover, the company entered into multiple deals during the quarter across various sectors (defense, solar, auto, railways, medical) as well as manufacturing capabilities (PCB, design-led manufacturing). With a strong 1HFY26, management has guided for revenue growth of over 30% and EBITDA margin of over 9% for FY26 (vs ~8.5-9% margin earlier).

* Factoring in the strong operating performance and the integration of Elcome’s financials from FY27, we raise our EPS estimate for FY27 by 6% while maintaining our FY26/FY28 estimate. We reiterate our BUY rating on the stock with a TP of INR960 (35x Sep’27E EPS).

Operating leverage aids margin expansion despite higher mix of IT

* Consolidated revenue grew 37.6% YoY to INR11.5b (est. INR10.6b), led by growth across all segments. IT and Railways grew the highest by 4x, followed by Consumer/Auto businesses/Healthcare by 35%/28%/26% YoY, while Industrials grew only by 9% (a major execution took place in 1Q). IT witnessed a significant jump, driven by the volume ramp-up for a major global OEM customer and the addition of Dynabook as a new client in 1H.

* EBITDA margin expanded 160bp YoY to 10.1% (est. 8.6%), led by a decrease in the share of employee and other expenses. EBITDA grew 62% YoY to INR1.2b (est. INR921m). Adj. PAT grew 77% YoY to INR641m (est. INR570m).

* The order book stood at INR58b in Sep’25 vs INR54-55b as of Jun’25. The Automotive/Industrials/ Consumer/ Healthcare/ IT and Railways segments accounted for ~35%/25%/25%/6-7%/remaining portion of total orders as of Sep’25.

* For 1HFY26, revenue/EBITDA/adj. PAT rose 5%/75%/2x to INR20.1b/INR2.0b/ INR1.1b.

* Gross debt stood at INR2.8b as of Sept’25 vs. INR6.1b as of Mar’25. The company reported a cash outflow of INR1.2b as of Sep’25 vs. CFO of INR2.1b as of Sep’24. Net working capital days stood at 73 days as of Sep’25, with management targeting to reduce it to below 65 days by the end of the year.

Highlights from the management commentary

* Acquisition of Elcome: SYRMA has signed a definitive agreement to acquire a 60% stake in Elcome Integrated Systems for INR2.35b (translating to 7.4x FY25 EV/EBITDA) through a mix of primary and secondary purchases. Elcome will use the funds to acquire Navicom Technology, enhancing its defense and maritime electronics capabilities. The remaining 40% stake will be acquired over the next three years. Elcome reported revenue of INR2b and an EBITDA profile of ~26% in FY25.

* PCBs Manufacturing: SYRMA has formed a joint venture with Shinhyup Electronics Co., Ltd., South Korea, to establish multi-layer and flexible PCB manufacturing capabilities. The JV has secured 26.7 acres in Naidupeta, Andhra Pradesh, for a PCB and CCL manufacturing campus, with both state and central incentives approved. The project targets INR25b of annual revenue based on a 1–1.5x asset turnover, with commercial production expected from FY28. The total planned capex of ~INR15.6b is expected to be deployed in phases, in line with demand build-up and ramp schedule. Further, the company aims to incur a capex of INR2b in FY26 and INR7b-INR8b over FY27 and FY28.

* Outlook and Guidance: The company has maintained revenue guidance of ~30- 35% for FY26, with an intact ~8.5-9% EBITDA guidance (expecting to surpass the guidance level). It anticipates the US to serve as a key market in the future.

Valuation and view

* SYRMA continued its margin recovery, driven by a favorable shift in the business mix and operating leverage in 1HFY26. We expect this trend to continue through 2HFY26, led by strong growth in higher-margin segments, such as automotive and industrial.

* We believe that the company’s long-term trajectory will continue to remain strong, backed by: 1) its focus on low-volume, high-margin business; 2) an increase in exports; 3) increasing share of revenue in the industrial and automotive segments; 4) a foray into bare PCB manufacturing through its JV; and 5) inorganic expansion into new verticals, such as defense and solar invertors.

* We have incorporated Elcomes’ financials from FY27, resulting in an incremental increase of 5%/12% in revenue/EBITDA for the existing EMS business in FY27. However, factoring in the QIP dilution (raised INR10b), we raise our EPS estimate for FY27 by 6% while maintaining our FY26/FY28 estimate.

* We estimate a revenue/EBITDA/adj. PAT CAGR of 31%/44%/51% over FY25-28, driven by strong revenue growth and margin expansion. We reiterate our BUY rating on the stock with a TP of INR960 (premised on 35x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412