Buy Astra Microwave Products Ltd for the Target Rs. 1,100 by Motilal Oswal Financial Services Ltd

Precision in motion!

Transitioning from a subsystems to a system-based player

Astra Microwave Products (AMPL) designs and manufactures high-quality radio frequency and microwave modules, subsystems, and systems in India. The company is moving from being a subsystem-level player to a complete system solutions provider and is eyeing opportunities from Active Electronically Scanned Array (AESA) radar, Uttam radar, meteorological orders, repeat orders from the Navy, and counter-drone orders over the next few years. The company’s order book stood at INR22b as of 30th Sep’25. AMPL posted 13% revenue CAGR over FY21-25. Driven by a changing business mix, the company was able to improve its EBITDA margin notably to 25.6% in FY25 from 12.3% in FY21. We expect the company’s revenue to post an 18% CAGR over FY25-28 and project its margin to improve 40bp over the same period to reach ~26% by FY28. This would lead to PAT CAGR of 23% over the same period. We initiate coverage on AMPL with a BUY rating and a TP of INR1,100, based on 38x Dec’27 estimates. This valuation reflects a 15% discount compared to target multiple of larger defense PSUs owing to its smaller size. We consider AMPL a long-term investment opportunity in defense electronics, anticipating its revenue growth to accelerate between FY27 and FY30 as larger orders are awarded by the Ministry of Defence (MoD) and defense PSUs.

Healthy addressable market across segments

The total addressable market for AMPL is ~INR240b-250b across all sectors through FY28. Within this addressable market, AMPL targets significant opportunities until FY28 in radar, missiles, telemetry, and turnkey projects, followed by other initiatives. The company’s offerings range across AAAU hardware, AESA multi-functional radar, Electronic warfare (EW) subsystems, jammers, telemetry subsystems, et al. Further, AMPL is actively participating in multiple Make-II programs of the Indian Air Force and the Indian Army, focusing on various radar systems. We thus expect AMPL to benefit from upcoming orders related to QRSAM, the Uttam radar for Tejas Mk1A, the EW suite and Virupaksha AESA radar for the Su-30 MK1 upgrade, weapon locating radars, and other defense segment projects over the next 1-2 years. We also project emerging opportunities in space, meteorology, exports, and other projects for AMPL over the medium to long term.

Revenue growth profile to change over the next 4-5 years

AMPL is targeting potential orders worth INR14-15b from QRSAM, INR10b from Uttam radar, and INR15-16b from the EW suite related to the Su-30MK1 upgrade. These will be followed by orders for the Virupaksha AESA radar and an additional INR15-16b from weapon-locating radars. The company is already qualified as one of the suppliers for these orders. Once awarded, we expect project execution to scale up during FY27–30, supplementing AMPL’s base orders. Additionally, AMPL is expected to benefit from meteorology-related orders through Mission Mausam and the launch of a satellite, which could increase revenues in meteorology and the space segment. Export opportunities are anticipated to take 1–2 years before contributing meaningfully to revenue.

Wide product portfolio

AMPL’s range of products encompasses offerings in defense, space, and hydro/ meteorology, along with expertise in antennas, MMIC, contract manufacturing, Homeland security, and environmental & EMI/EMC testing services. It supplies various kinds of EW subsystems and components to DPSUs and the programs of the Indian Air Force, Navy, and Army. It is also associated with Jammer’s program for LCA Mk1A, Su-30 MKI, and other fighter platforms in India. It is also a critical partner of Bharat Electronics (BEL) for EW. It supplies various subsystems for Telemetry applications such as S-Band FM Transmitter, Airborne RF Trans receiver, Ground Up-down Converters, C & S Band Switch Antenna Systems, Telemetry Tracking systems, etc. Currently, 80% of the company’s defense segment revenue originates from subsystems and 20% from systems. The company plans to alter the ratio to 50-50% in the future.

Strong order book, JVs, and alliances enhance revenue visibility

AMPL has a strong order book of INR22b, providing revenue visibility for three years. With this, we expect revenues to clock 18% CAGR over FY25-28. Along with this, the company has also formed JVs and alliances with various players to enter new areas such as explosives (with Premier Explosives to get hard-kill capabilities for anti-drones), navigation systems (with Manjeera Digital to manufacture navigation chips), tactical radio communication systems, and electronic warfare (EW) with M/s Rafael Advanced Defense Systems. These JVs and alliances further enhance revenue visibility for the company via newer areas.

Strong client base

The company has a strong client profile. Its clientele includes RCI, BrahMos, Gaetec, Bharat Electronics, Bharat Dynamics Limited, Electronics Corporation of India Limited, HAL, BSF, IITM, GUVNL, Adani Defense and Aerospace, L&T, IAI ELTA, Rafael, Elbit Systems, Thales, Sematron Italia, Raytheon Technologies, ISTRAC, URSC, Antrix Corporation, NARL, SAE, CSIR-NAL, MGAM, the Government of Telangana, the Central Water Commission, and the India Meteorological Department.

Focusing on working capital reduction

Management targets a reduction in working capital, which would particularly be driven by a reduction in receivables. The receivables had moved up in the last 3-4 years, especially driven by certain orders related to radars, where payments are linked to acceptance of those radars by the client. These receivables, worth nearly INR1.7b, are likely to be received during FY26. Therefore, we expect AMPL’s NWC days to come down for FY26. This will enhance operating cash flows for the company. However, we do not expect a sharp reduction in NWC days going forward.

Financial outlook

AMPL reported a revenue CAGR of 13% over FY21-25, mainly driven by the execution of defense and export orders over FY23-25. EBITDA margin improved to 25.6% in FY25 from 12.3% in FY21, fueled by the completion of low-margin export orders. AMPL raised INR2.25b at the beginning of FY24 to strengthen its balance sheet. However, gross borrowings rose from INR1b in FY21 to INR4.2b by FY25 due to an increase in the net working capital cycle. We expect the company’s revenue/EBITDA/ PAT to record a CAGR of 18%/19%/23% over FY25-28, while its RoE and RoCE are expected to remain at comfortable levels of 13-17% in FY28.

Future growth strategy

The company expects to capitalize on the strong growth prospects in the defense sector by 1) moving up the value chain from manufacturing subsystems for OEM customers to manufacturing complete systems, 2) entering into collaborations and JVs for complex projects, 3) providing comprehensive solutions to clients, 4) diversifying revenue mix, 5) increasing the share of higher-margin domestic orders vs. exports, and 6) maintaining a strong balance sheet.

Valuation and recommendations

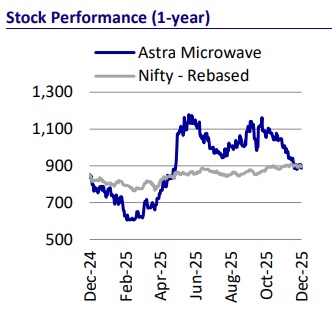

At the current price of INR888, the stock is trading at 37.4x/29.3x P/E on FY27E/ FY28E financials. We initiate coverage on AMPL with a BUY rating and a TP of INR1,100 based on 38x Dec’27 estimates. Our target multiple at a 15% discount to the target multiple of larger PSU owing to its smaller size. We view Astra Microwave to be a long-term play in defense electronics, with its revenue growth profile to improve more during FY27-30 as larger orders get awarded from MoD.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)