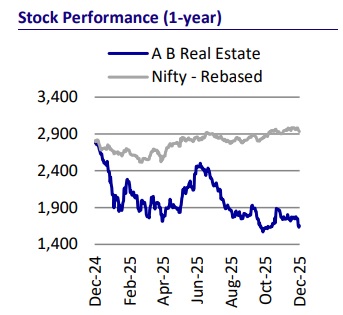

Buy Aditya Birla Real Estate Ltd for the Target Rs. 2,275 by Motilal Oswal Financial Services Ltd

Shaping homes | Crafting legacies!

Expect to clock a 26% presales CAGR % over FY25-28

Leveraging brand legacy to drive 26% presales CAGR

* ABREL commenced operations in 2016 under the ‘Birla Estates’ division of its listed entity, Century Textiles. Following the divestment of legacy businesses such as textiles and pulp & paper, the company was rebranded as ‘Aditya Birla Real Estate Limited’ in Oct’24, emerging as a focused real estate platform.

* From its inception, ABREL has positioned itself in the premium, luxury, and ultra-luxury housing segments, with selective forays into the commercial and retail spaces. Its business model is built on redevelopment opportunities, joint development agreements, and asset-light partnerships, complemented by selective outright acquisitions.

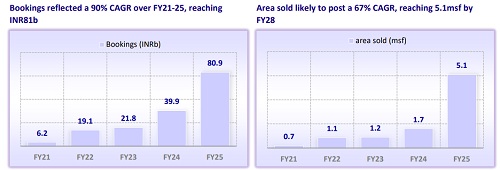

* This capital-efficient approach has enabled the company to scale rapidly, delivering ~INR 81b in presales in FY25, reflecting a strong 90% CAGR since FY21.

* Over the years, ABREL has developed a robust launch pipeline totaling 35.1msf (~INR700 b of GDV) for the next 2-4 years. This includes ~INR51b in unsold inventory from ongoing projects, ~INR462b from upcoming launches, and INR186b from sold inventories (excluding Birla Pravaah which is sold in 3QFY26).

* With design-led offerings and strong positioning in core markets such as the Mumbai Metropolitan Region (MMR), Bengaluru, Pune, and the National Capital Region (NCR), ABREL is likely to deliver ~26% CAGR in presales over FY25-28.

* ABREL benefits from the longstanding brand equity of the Aditya Birla Group, a trusted conglomerate with decades of presence across diverse industries. This heritage enhances customer confidence, attracts high-quality land partners, and enables smoother execution—providing a strong competitive advantage in a fragmented market.

* We initiate coverage on ABREL with a BUY rating and a TP of INR 2,275, implying a 33% upside potential.

Strong cash flow visibility backed by robust collections

* Collection CAGR at 52%: Collections recorded a robust 104% CAGR over FY21- 25, outpacing presales by 14%. With 50-60% of the projects expected to be completed by FY28, collections are projected to reach INR94b by FY28, reflecting a 52% CAGR from FY25 levels. This underscores strong buyer demand and ABREL’s efficiency in converting bookings into actual cash.

* Collection efficiency target of 60%: Collection efficiency is expected to improve from 33% to ~60% by FY28, significantly boosting operating cash flows. This enhanced cash conversion will allow ABREL to fund growth and working capital needs without depending heavily on external debt.

* Inventory cash potential of INR176b: With unsold inventory of INR50.9b and pending collections from sold inventory of INR120.3b, ABREL has strong nearand medium-term visibility into cash inflows. This provides a solid financial base to support continuous launches and strategic expansions.

* Surplus post-costs at INR74.2b: After accounting for INR96.9b in project completion costs, ABREL anticipates a surplus of INR74.2b. This surplus provides flexibility to reduce debt, accelerate execution, and fund new projects, enhancing overall financial stability.

Financials upcycle ahead with 69% CAGR revenues and margin expansion

* ABREL has built a pan-India presence with launches across MMR, Pune, Bengaluru, and NCR, including key projects such as Birla Vanya, Birla Niyaara, Birla Alokya, Birla Trimaya, and Birla Navya. The company has a strong development pipeline, with ~INR139b of launches planned for FY26 across these core markets.

* Its portfolio spans luxury to mid-premium housing in both established and emerging locations, reflecting a strategy of geographic diversification, balanced market exposure, and scale benefits. This approach not only supports growth but also mitigates risks and enhances brand strength.

* With project completions anticipated to gather pace, ABREL’s revenue trajectory is set for a sharp upswing, projected to record a CAGR of 69% over FY25–28 to reach INR58.9b. For FY26 alone, revenue growth is estimated at 20% YoY, taking the total revenue to INR14.6b. This strong momentum highlights the company’s ability to translate its development pipeline into sizeable financial outcomes.

* On the profitability front, EBITDA and PAT are anticipated to witness significant acceleration, projected at INR10.1b and INR9.8b, respectively, by FY28E.

* Reported margins are expected to strengthen meaningfully, with EBITDA margin rising to 17.2% and PAT margin turning 16.7% in FY28E, a marked improvement from FY25. Return ratios are also forecast to improve, with ROE estimated at 21.9% and ROCE at 10.7%, underscoring the company’s stronger earnings profile and capital efficiency.

* and view

* ABREL reported a strong 90% CAGR in presales over FY21-25, driven by an increase in projects under execution, geographic diversification, and premium realizations. With a strong launch pipeline of upcoming premium projects, the company is expected to sustain momentum and post a 26% CAGR in bookings over FY25-28.

* Strong presales growth will drive rapid scaling of operations across key parameters, such as cash flows, revenue, and profitability, boosting confidence in the company’s execution capabilities and future growth prospects.

* Based on the DCF method, we value ABREL’s residential project pipeline at INR184b.

* Existing commercial projects are valued at INR15b, while the 157-acre land bank is valued at INR39b.

* We initiate coverage on ABREL with a BUY rating and an SoTP-based TP of INR2,275/share, implying a 33% upside potential.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412