Neutral Nestle India Ltd For Target Rs.2,400 by Motilal Oswal Financial Services Ltd

Long-term drivers intact; rich valuation limits upside

Nestle India (Nestle) hosted an analyst meet wherein the company highlighted its growth strategy, business moats and competitive positioning across the categories. Here are the key takeaways:

* Nestlé sees strong growth potential in India, as its per capita packaged food consumption remains low. With 60 million people expected to join the middle- and high-income segments by 2030, rising affordability will boost demand.

* Nestlé’s growth strategy focuses on efficiency, brand investment, and market share expansion to drive profitability. The company focuses on premiumization, which is outpacing the overall growth. Innovation contributed 6.5% of sales in 9MFY25, which Nestle aims to increase to 10% in the medium term. The company has a strong distribution network of 5.3 million outlets (1.7 million direct reach). It achieved 33% growth in ecommerce (8.5% of total sales).

* In 9MFY25, growth was impacted by a consumption slowdown, commodity inflation, urban-rural disparities (with rural outperforming urban), and geopolitical uncertainties. Domestic volume growth was flat YoY and sales grew 3% YoY, driven by pricing. Barring beverages, Kitkat, Milkmaid, and the toddler range, demand weakness was broad-based, particularly in noodles, due to pricing actions and competitive pressure from local brands. Volatility in coffee and cocoa prices remains a challenge, and further price hikes may be considered if inflation persists. GP margin contracted 60bp YoY to 56.9%, while EBITDA margin declined 160bp YoY to 23.3% in 9MFY25.

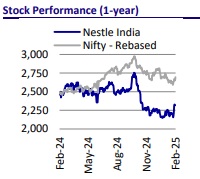

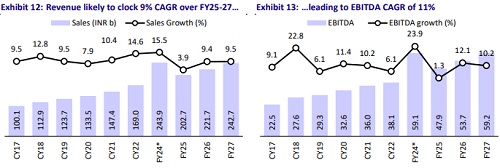

* Over the long term, Nestlé intends to focus on volume-led growth. We model a 9% revenue CAGR over FY25-27E, driven by rural expansion, out-of-home consumption, capacity expansion, and premiumization. However, there are near-term risks such as moderating urban consumption and high food inflation. The stock trades at 63x FY26E/56x FY27E EPS, and given its expensive valuation, we maintain a Neutral rating with a TP of INR2,400 (based on 60x P/E Dec’26E).

Valuation view

* The long-term narratives for Nestle’s revenue and earnings growth are attractive. India’s packaged food market offers strong growth opportunities. Nestle has been focusing on its RURBAN strategy; hence, growth was higher in RURBAN markets. Most of Nestle’s categories have been reaping the benefits of distribution penetration. Packaged food penetration has improved in the tier-2 and rural markets. Nestle continues to focus on portfolio enhancement through ongoing innovation and premiumization initiatives.

* However, there are near-term risks such as moderating urban consumption and high food inflation, and it is critical to watch operating margins.

* We estimate a CAGR of 9%/11%/12% in net sales/EBITDA/APAT during FY25- 27. The stock trades at 63x FY26E/56x FY27E EPS, and given its expensive valuation, we maintain a Neutral rating with a TP of INR2,400 (based on 60x P/E Dec’26E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)