Buy Life Insurance Corporation Ltd for the Target Rs. 1,050 by Motilal Oswal Financial Services Ltd

APE decline continues; VNB margin expands YoY

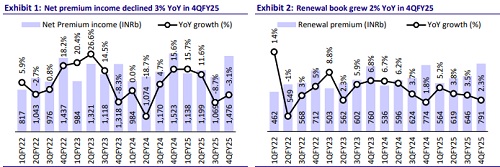

* In 4QFY25, LIC reported a net premium income of INR1.5t, which declined 3% YoY. For FY25, net premium income grew 3% YoY to INR4.9t. Renewal premium grew 2% YoY to INR791b.

* New business APE declined 11% YoY to INR189b (8% beat). For FY25, the performance was flattish YoY, with APE at INR568b.

* Absolute VNB declined 3% YoY to INR35b (in line). For FY25, it grew 4% YoY to INR100b. VNB margin expanded to 18.7% YoY from 17.2% in 4QFY24 but was lower than our expectation of 20.1%. For FY25, VNB margin expanded 80bp YoY to 17.6%.

* Management expects premium growth to recover soon, although the reduction in the number of policies issued may take longer to stabilize.

* We have cut our VNB margin estimates by 50bp each for FY26/27, factoring in FY25 performance. Reiterate BUY with a TP of INR1,050 (premised on 0.6x FY27E EV).

Rising non-par contribution benefitting VNB margin

* LIC’s first year/single premium declined 20%/6% YoY to INR111b/577b.

* The decline in individual APE of 9% YoY was largely due to a 12% YoY decline in the par business during 4QFY25, while its contribution remained largely stable at 52.2%. The non-par business witnessed a 1% YoY growth, with an improvement in contribution to 20% in 4QFY25 (17.7% in 4QFY24).

* The shift in product mix toward the non-par segment, along with an increase in non-par product margins (~21%), led to an 80bp YoY improvement in the VNB margin in FY25.

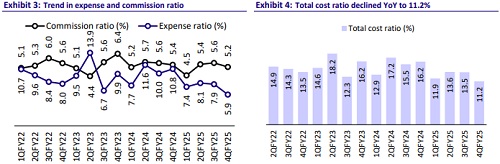

* Commission expense declined 6% YoY to INR77.1b but is expected to grow with strong agent expansion and productivity improvement. Operating expenses declined 47% YoY to INR87.8b due to a focus on expense optimization and employee base reduction.

* Income from investments in policyholders’ account grew 10% YoY to INR931.3b, while it increased 57% YoY to INR17.6b in shareholders’ account. Total AUM grew 6% YoY to INR54.5t.

* On the distribution front, contribution from agency channel was at 89.7% in 4QFY25, with individual NBP growing 1% YoY. Individual NBP from bancassurance doubled YoY in 4QFY25 (9.9% of individual NBP), backed by higher demand for ULIP sales.

* LIC maintains the highest agency force in the country, with ~1.5m agents, of which 55.32% have a vintage of more than five years.

* The 13th/37th/61st month persistency stood at 68.6%/59.6%/58.5% in 4QFY25. The company implemented multiple measures last year to achieve improvement in persistency and expects a positive impact of the same in the near future.

* Solvency improved to 211% at the end of FY25.

* EV was reported at ~INR7.8t at the end of FY25, reflecting an RoEV of 6.8% and an operating RoEV of 11.4%, largely due to an impact from MTM and a decline in the risk-free rate.

Highlights from the management commentary

* LIC remains focused on expanding its non-par business to enhance profitability and offer better policyholder benefits, particularly in a declining interest rate environment. The company sees multiple growth opportunities in the non-par segment and is firmly pursuing this as a long-term strategy.

* A full open architecture bancassurance model would entail substantial costs and complexity, potentially affecting productivity, according to management. The existing agent model continues to offer strong economic and social incentives, ensuring retention.

* Starting this year, LIC has begun hedging its non-par portfolio to mitigate risks and intends to expand coverage of this hedging strategy as market conditions allow.

Valuation and view

* LIC maintains its industry-leading position and is focused on achieving growth recovery through wider product offerings, higher ticket size, a shift in the product mix toward non-par, agency channel expansion, and a higher contribution from bancassurance and alternate channels. Improvement in rider attachment, along with an increase in contribution from higher margin products, will boost VNB margin. We have cut our VNB margin estimates by 50bp each for FY26/27, factoring in FY25 performance. Reiterate BUY with a TP of INR1,050 (premised on 0.6x FY27E EV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)