Buy Granules India Ltd for the Target Rs. 600 by Motilal Oswal Financial Services Ltd

Broadly in-line quarter; margin resilience led by FDF

Gagillapur remediation, Senn integration weigh on near-term profitability

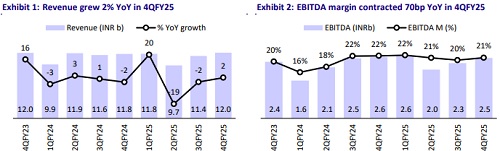

* Granules India (GRAN) delivered a slightly better-than-expected revenue in 4QFY25. However, it reported largely in-line EBITDA/PAT for the quarter.

* GRAN achieved the highest-ever gross margin on a quarterly basis, fueled by a strategic shift of product mix towards finished dosage formulation (FDF).

* Geography-wise, GRAN has garnered consistent growth in the North America segment, forming 77% of total sales for FY25.

* GRAN continues to work on product pipelines for other geographies such as the EU, LATAM, India, and the ROW markets.

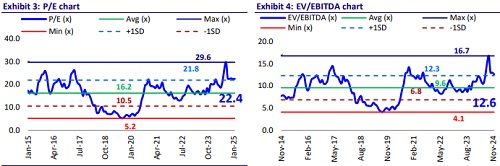

* We cut our earnings estimates by 8%/6% for FY26/FY27 factoring in 1) an extended production disruption at the Gagillapur site to implement remediation measures, 2) additional operational costs related to Senn Chemicals, and 3) a weak pricing in Paracetamol API. We value GRAN at 18x 12M forward earnings to arrive at our TP of INR600.

* GRAN is focusing on building a differentiated product pipeline in the oncology and ADHD domains. With the Senn Chemicals acquisition, it is adding peptide CDMO as a growth driver for the future. It is also adding capacities in the FDF segment to cater to future manufacturing requirements. Overall, we expect a 14%/20%/26% revenue/EBITDA/PAT CAGR during FY25-27. Reiterate BUY.

Segmental mix benefit offset by higher opex on a YoY basis

* GRAN’s 4QFY25 sales grew 1.8% YoY to INR11.9b (our est. of INR11.3b), led by increased sales in the FDF segment.

* FDF sales grew 7% YoY to INR9.2b (77% of sales).

* API sales declined 9% YoY to INR1.4b (13% of sales).

* Intermediate (PFI) sales declined 17% YoY to INR1.2b (10% of sales).

* Gross margin (GM) expanded 330bp to 63.4% due to a change in the segmental mix and lower RM costs.

* However, the EBITDA margin dipped 60bp YoY to 21.1% (our est. of 22.3%) due to higher employee costs/other expenses (up 120bp/270bp as % of sales).

* EBITDA was flat YoY at INR2.5b (our est. of INR2.5b) for the quarter.

* During the quarter, GRAN received an insurance claim (INR307m) for business disruption due to an incident related to information security.

* Adjusted PAT was stable YoY to INR1.2b (our estimate: INR1.2b).

* In FY25, GRAN’s revenue was flat YoY at INR44.8b, while EBITDA/PAT grew 7.8%/11.9% YoY to INR9.4b/INR4.7b.

Highlights from the management commentary

* The ongoing remediation measures at the Gagillapur facility to resolve the USFDA regulatory issue are likely to impact production for a couple of more quarters.

* GRAN is awaiting USFDA/EU inspection at the Genome Valley Phase I plant. It started the Phase II plant and commenced validation activities recently.

* In addition to the amount spent on acquiring Senn Chemicals (~INR2b), GRAN would be further investing to integrate and scale up capacities/ capabilities in the CDMO segment.

* The company submitted one ANDA in the oncology segment, and there are about 10 products under development.

* The paracetamol API business remains considerably impacted due to adverse supply-demand scenarios.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412