Neutral Infosys Ltd for the Target Rs. 1,650 by Motilal Oswal Financial Services Ltd

Still not out of the woods

Upgraded revenue guidance still points to slow 2H

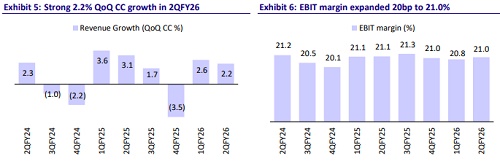

* Infosys (INFO) reported 2QFY26 revenue of USD5.0b, up 2.2% QoQ in CC/ 2.9% YoY in CC vs. our estimate of 2.4% QoQ in CC. EBIT margin stood at 21.0% vs. our estimate of 21.2%. EBIT increased 6% QoQ/8% YoY to INR93.5b (est. INR94b). PAT came in at INR74b, up 6.4% QoQ/13.2% YoY, above our estimate of INR72b.

* Management upgraded the lower end of its FY26 CC revenue growth guidance from 1% to 2%, now expecting growth in the 2-3% range. Large deal TCV stood at USD3.1b, down 18.4% QoQ. The book-to-bill ratio was 0.6x. Net new TCV was down 34% QoQ. For 1HFY26, revenue/EBIT/PAT grew 8%/7%/11% YoY in INR terms. We expect INFO’s revenue/EBIT/PAT to grow 8%/8%/6% YoY in 2HFY26. We reiterate our NEUTRAL rating on INFO with a TP of INR1,650, implying a 12% potential upside.

Our view: 2H growth to remain subdued

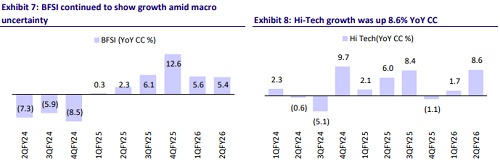

* 2Q growth was decent in a seasonally strong quarter, but the top end of guidance was maintained: 2Q growth was a decent 2.4% QoQ CC, led by hitech and manufacturing. That said, the top end of the guidance was maintained, pointing to continued macro uncertainty and a slower-thanexpected pickup in discretionary demand. While the company highlighted pockets of BFSI where discretionary spending was returning, the overall picture remained unchanged. The ask rate for the top end of guidance is negative 0.2% for the next two quarters, suggesting similar seasonality to previous years: we expect 3Q to remain flat, whereas 4Q revenue is anticipated to decline sequentially by 1.5%.

* Margins protected in the short term: EBIT margin stood at 21.0% (up 20bp QoQ), below our estimate of 21.2%. Currency tailwinds and Project Maximus contributed 90bp, partially offset by 70bp due to higher post-sales customer support. Despite a few large deals ramping up, management indicated that it would largely be able to defend margins in the short term. We expect flat margins across the next three years for the industry as well as INFO, as pricing pressures in a muted demand environment and deflationary pressures could create headwinds. Currency is a mitigating factor, but risks skew to the downside.

* Deal bookings strong, but revenue conversion still elusive: Deal bookings came in robust, up 29% YoY. However, revenue conversion still remains elusive. Despite an upgrade to the lower end of the guidance, the top end was retained, pointing to continued macro uncertainty and a slower-thanexpected pickup in discretionary spending.

Valuation and changes to our estimates

* Our estimates are unchanged. We value INFO at 22x Jun’27E EPS. This yields a rounded TP of INR1,650, implying a 12% potential upside. We reiterate our NEUTRAL rating on the stock, citing continued macro uncertainty as well as low appetite for transformation spends from clients.

Miss on revenue and margins; bottom end of FY26 guidance upgraded; ask rate (CQGR) for top end of guidance: -0.2%

* USD revenue increased 2.7% QoQ to USD5.0b. In CC, it was up 2.2% QoQ, below our estimate of 2.4% QoQ.

* The company guided for FY26 CC revenue growth between 2% and 3%, increasing the lower end of the guidance from 1% to 2%. The ask rate (CQGR) for the top end of guidance was -0.2%.

* In 2QFY26, Hi-Tech/Manufacturing/Communications grew 9.3%/5.3%/3.6% QoQ, BFSI rose 2.0% QoQ, whereas Retail declined 2.6% QoQ.

* EBIT margin was at 21.0%, below our estimates of 21.2%. EBIT margin guidance was maintained in the 20-22% range.

* PAT was up 6.4% QoQ/ 13.2% YoY at INR74b (above our est. of INR72b).

* Employee count was up 2.5% QoQ, standing at 3,31,991. ? Large deal TCV stood at USD3.1b, down 18.4% QoQ. The book-to-bill ratio was 0.6x.

* LTM attrition was down 10bp QoQ at 14.3%. Utilization declined 10bp QoQ to 85.1% vs 85.2% in 1Q (ex-trainees).

Key highlights from the management commentary

* Enterprise AI companies are increasingly building modernization solutions for clients, and INFO is partnering with several of them, leveraging its deep knowledge of enterprise IT landscapes.

* The company continues to make strategic investments in its sales engine, technology capabilities, and workforce.

* Volumes remained soft; most growth came from better pricing realization, aided by more working days and value-based engagements under Project Maximus, which helped enhance effective pricing.

* Furlough patterns are expected to be similar to last year.

* INFO revised its FY26 CC revenue growth guidance to 2-3%, raising the lower end from 1% earlier.

* The lower end of the guidance reflects elevated uncertainty, while the higher end assumes a stable demand environment.

* The company expects third-party expenses to remain lower than last year and sees no abnormal elevation ahead.

Valuation and view

* Despite an upgrade to the lower end of the guidance, the top end was retained—pointing to continued macro uncertainty and a slower-than-expected pickup in discretionary spending. Our estimates are unchanged. We value INFO at 22x Jun’27E EPS. This yields a rounded TP of INR1,650, implying a 12% potential upside. We reiterate our NEUTRAL rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412